Bouwinvest is charged with the management and administration of the Fund. It is authorised to conduct any and all business activities related to the entire real estate investment process to achieve the Fund’s investment objectives. Bouwinvest believes responsible business practices are a vital element in achieving the targeted return on investment. Bouwinvest is structured as a private limited company. bpfBOUW holds 100% of the shares in Bouwinvest.

Board of Directors

Bouwinvest has a Board of Directors, consisting of one Statutory Director, also Chairman of the Board, and three managing directors: the Managing Director Finance & Risk, the Managing Director Dutch Investments and the Managing Director International Investments. The Statutory Director is appointed by the General Meeting of Shareholders of Bouwinvest following nomination by Bouwinvest’s Supervisory Board. The Board of Directors is governed by a set of regulations that also outline its tasks and responsibilities.

Supervisory Board

Bouwinvest has an independent Supervisory Board with a minimum of three and a maximum of five members. The Supervisory Board currently has four members. The maximum term of office is four years, with the possibility of reappointment for an additional four years. The role of the Supervisory Board is to supervise the policies of the Board of Directors and the general affairs of the company and its related business. The Supervisory Board is responsible for the quality of its own performance. The members of the Supervisory Board are appointed by the General Meeting of Shareholders of Bouwinvest. In carrying out its duties, the Supervisory Board is guided by the interests of the management company and its related business.

Policies, rules and regulations

Corporate Governance Code

Although the Dutch Corporate Governance Code does not directly apply to Bouwinvest as it is an unlisted company, the Board of Directors endorses the best practices of the Code as far as applicable to Bouwinvest.

Code of Conduct

Bouwinvest has drawn up a Code of Conduct that applies to all its employees and which includes additional rules that specifically apply to the Board of Directors and Supervisory Board with respect to conflicts of interest and investments. The Code of Conduct deals with issues such as ethical behaviour, conflicts of interest, compliance with laws and (internal and external) regulations, CSR, health and safety, as well as our business partners. Bouwinvest has also instituted a whistleblower policy to deal with the reporting and investigation of unethical behaviour. All employees receive code of conduct training.

Compliance

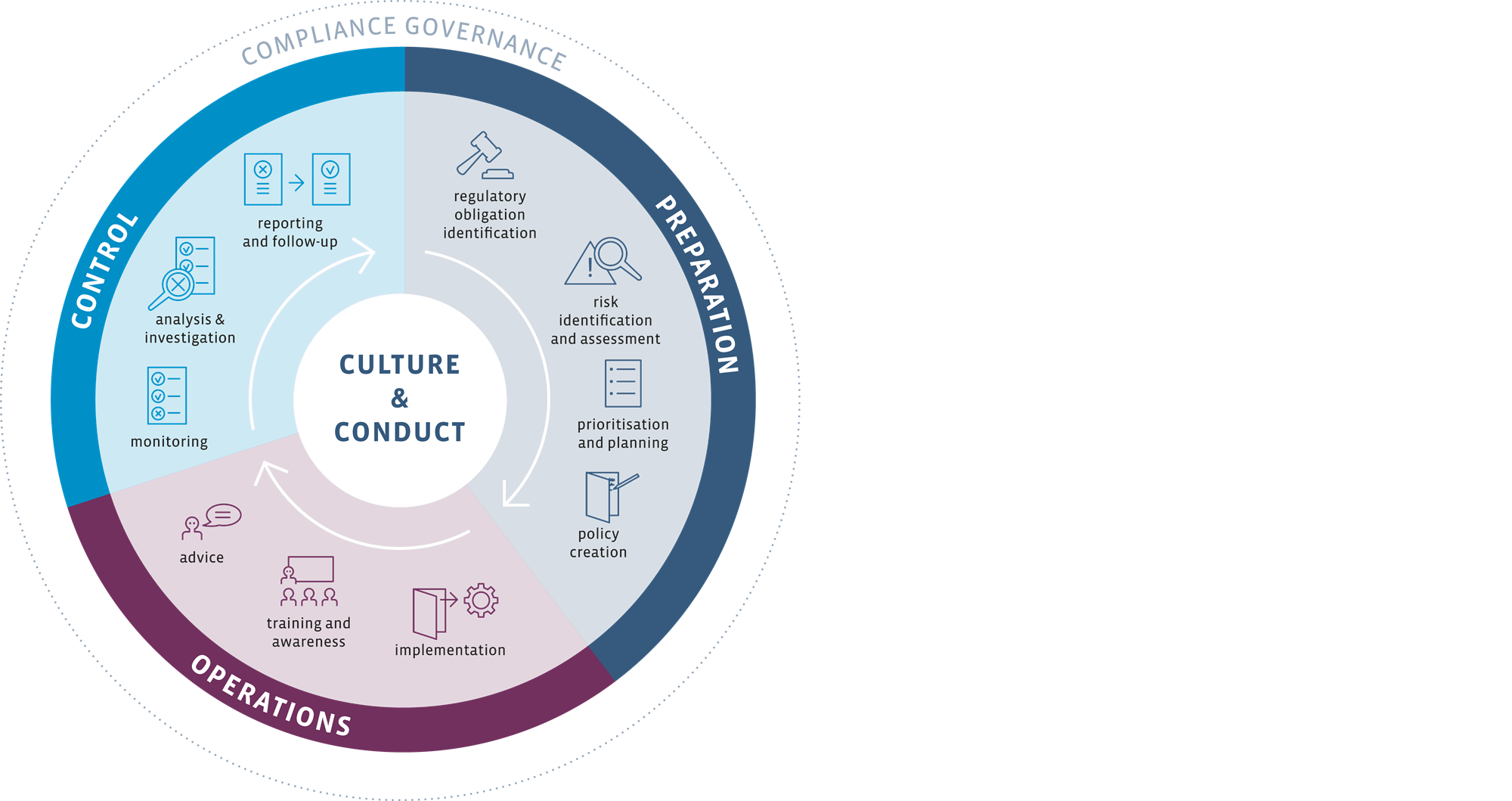

Bouwinvest has a dedicated Compliance function that identifies, assesses, advises on, monitors and reports on the company’s compliance risks. For the planning, execution and reporting of all compliance activities, the compliance function employs the Bouwinvest Compliance Cycle. This cycle contains ten groups of activities that are key for the compliance function. The compliance risks include the risk of legal or regulatory sanctions, financial loss, or loss of reputation that the management company may suffer as a result of any failure to comply with applicable financial regulations, codes of conduct and standards of good practice. The compliance officer reports to the Statutory Director on a monthly basis, as well as to the chairman of the Supervisory Board on issues related to the Board of Directors.

Compliance cycle

Conflicts of Interest policy

Bouwinvest has a Conflicts of Interest policy. The purpose of this policy is to ensure that no material conflicts of interest occur that are damaging for investors in the fund, the fund or Bouwinvest. The policy also describes how Bouwinvest should act with respect to the allocation of different investment opportunities over the respective funds and clients. The policy is intended to supplement but not replace any applicable Dutch laws governing conflicts of interest.

In 2017, there were no conflicts of interest as referred to in the Bouwinvest Conflicts of Interest Policy, either between the members of the Board of Directors, the management company, the Fund and/or other funds managed by the management company.

Funds managed by Bouwinvest

Bouwinvest manages the following funds:

Bouwinvest Dutch Institutional Residential Fund N.V.

Bouwinvest Dutch Institutional Retail Fund N.V.

Bouwinvest Dutch Institutional Office Fund N.V.

Bouwinvest has a separate mandate from bpfBOUW for the management of international real estate investments, Bouwinvest Dutch Institutional Hotel Fund N.V. and Bouwinvest Dutch Institutional Healthcare Fund N.V.