Portfolio composition at year-end 2017:

€ 469 million in Dutch office properties, all in the Fund's core regions (14 assets, 194,717 m2 of lettable floor space)

€ 82 million in Dutch office redevelopment projects (2 assets, 18,453 m² of lettable floor space)

€ 45 million in Dutch office development project (1 asset, approx. 21,058 m2 of lettable floor space)

Investments, divestments and redevelopments

The Fund invested in redevelopments and optimised the quality of the Fund's assets. The size of the Fund's total portfolio increased to € 596 million in 2017 from € 503 million in 2016. This growth was largely driven by positive revaluations, which were the result of improved circumstances in the investment and occupier markets as well as various active asset management activities leading to new and renewed leases.

Investments

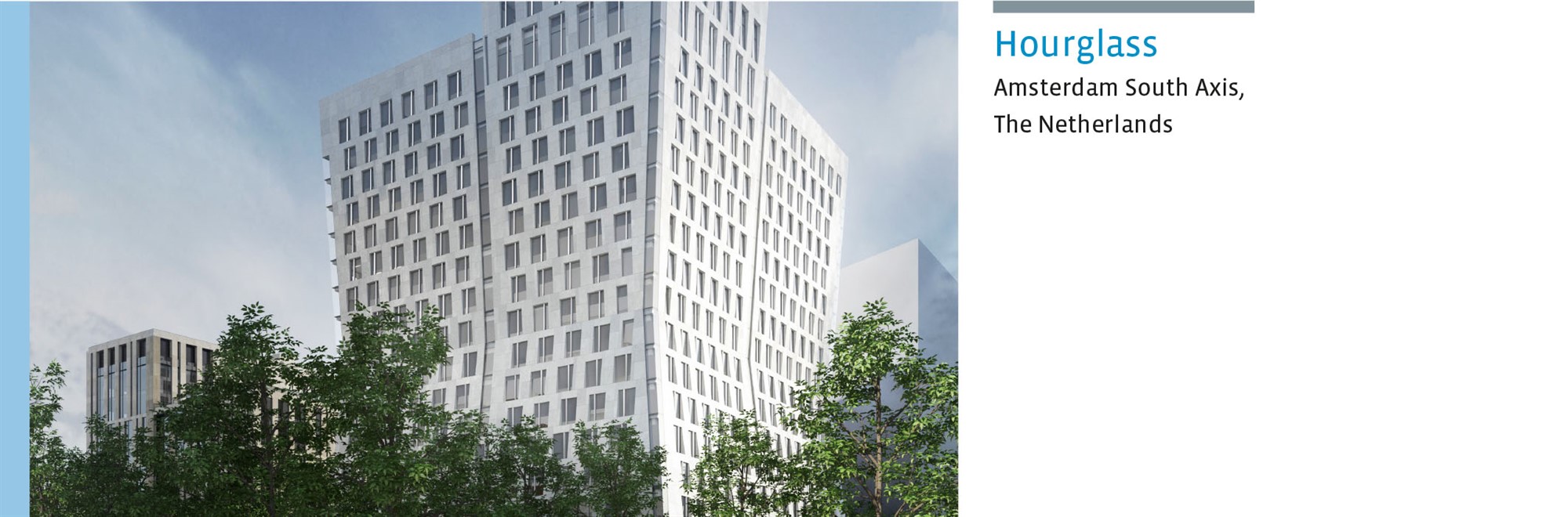

Hourglass, Amsterdam

Since the transaction for this acquisition in October 2016, the Fund has assessed several requests from the seller (development company Sax) to finalise the design of the building. The Fund has completed a ground lease agreement and paid the first instalment upon the delivery of the ground lease. In October 2017, Sax organised a festive start of construction. The Q3 2017 valuation of Hourglass showed a substantial increase in value compared to the purchase price and this made a significant contribution to the indirect return in 2017. The delivery is still foreseen for Q4 2019.

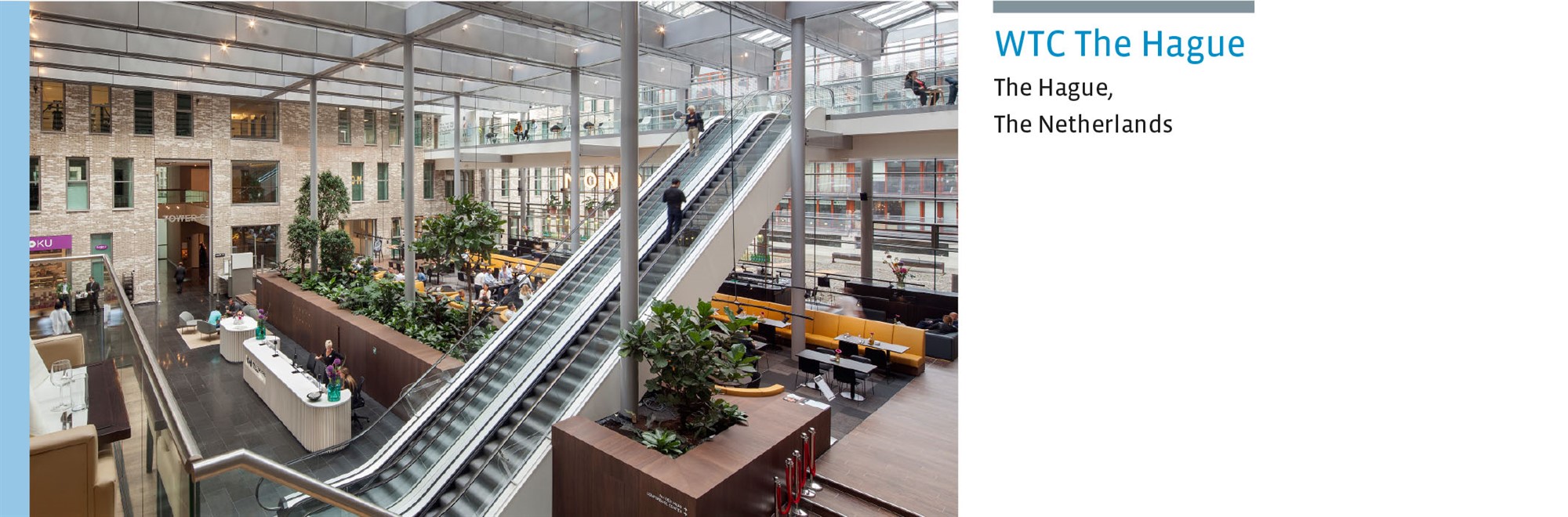

WTC The Hague

The completion of a renewed central entrance for WTC The Hague in 2016 boosted the dynamics in the building in 2017. This vibrant space inspired companies to hold their meetings and events in WTC The Hague, which welcomed many guests and reinforced its attractiveness as a business meeting place in The Hague and the immediate region. The upgrade also supported new lettings and lease renewals, which resulted in an increase in the occupancy rate.

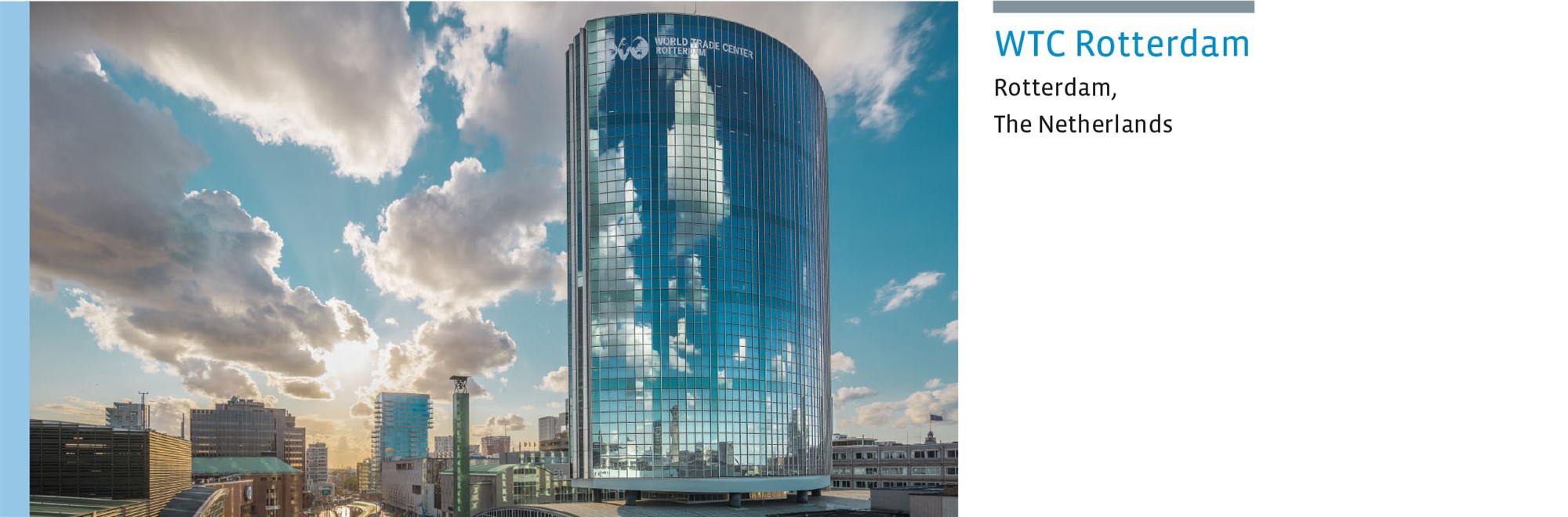

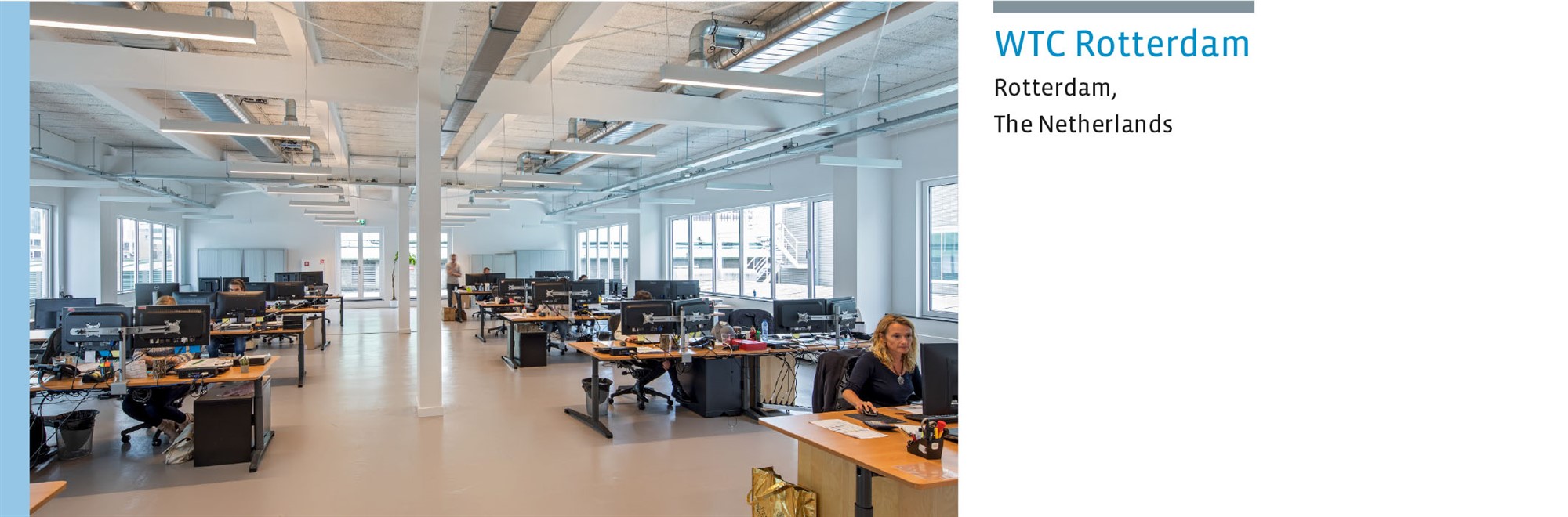

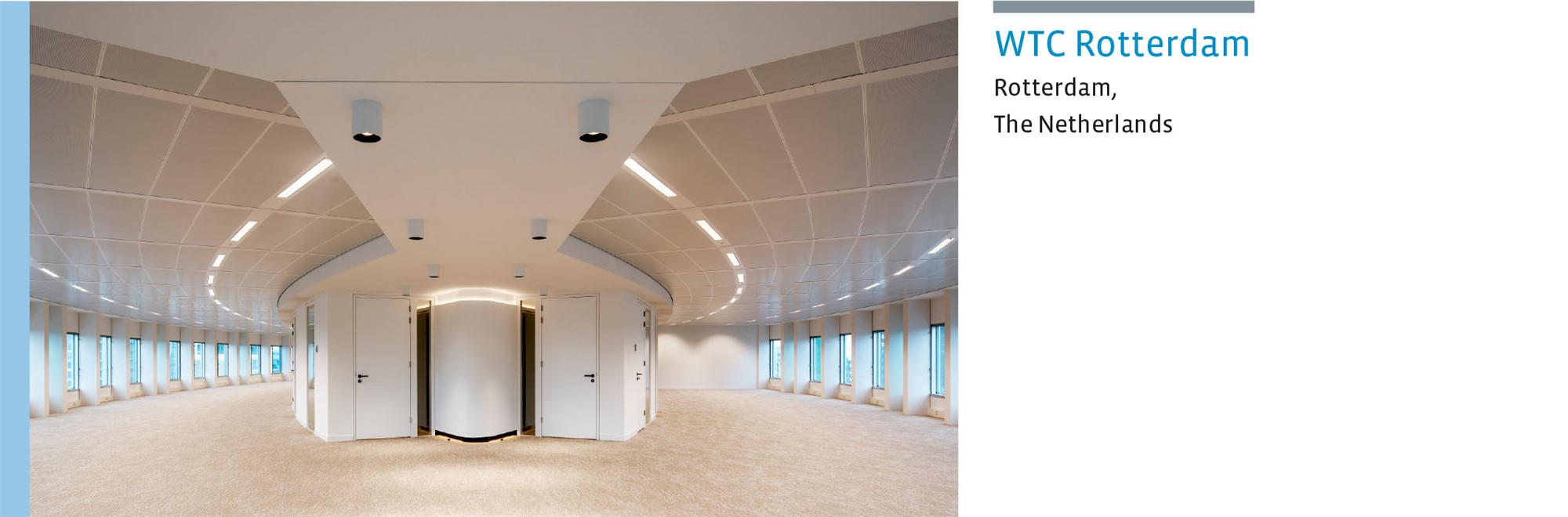

WTC Rotterdam

The WTC Rotterdam building has been enhanced on a number of fronts. These include the completion of the renovation of additional high rise office floors , the preparations for a future fitness training space and the start of a project to upgrade the central entrance area. The latter capital expenditure consists of a change in lay-out for service desks, the upgrading of the lobby area, including a stylish coffee corner and the relocation of flexible working spaces from the third floor in the low-rise section to an accessible and inviting location adjacent to the main entrance of the building. The listed status of the building means we are obliged to coordinate any changes with Dutch National Cultural Heritage Agency (Rijksdienst voor Cultureel Erfgoed). The investments in this project will be made in phases. We started the refurbishment of the Main Hall in 2017 and this will continue in the years ahead.

WTC Rotterdam’s renovated, modernised and more sustainable office spaces in the high-rise building are attracting a great deal of interest from (potential) tenants. The Fund also developed a concept to accommodate a cluster of insurance companies.

A substantial lease for 5,000 m2 with Hogeschool Rotterdam expired in the period under review. The Fund plans to transform most of the space left vacant into a hotel. We are currently conducting a feasibility study and tender procedure. Although this does temporarily affect the occupancy rate, future lettings will be supported by the addition of complementary facilities.

Nieuwe Vaart, Utrecht

Capital expenditures on the Nieuwe Vaart building in Utrecht have supported new lettings, and this asset is now full occupied. A focus on sustainable investments has led to a cluster of new tenants, all of which share a strong CSR policy. The Fund organised a festive re-opening of the building on 17 May 2017, together with all the tenants. The Colour Kitchen’s restaurant facilities now provide a social space for networking meetings between colleagues and tenants, while flexible meeting rooms are available for rent, exclusively for tenants.

Divestments

The Fund made no divestments during the year under review.

Redevelopments

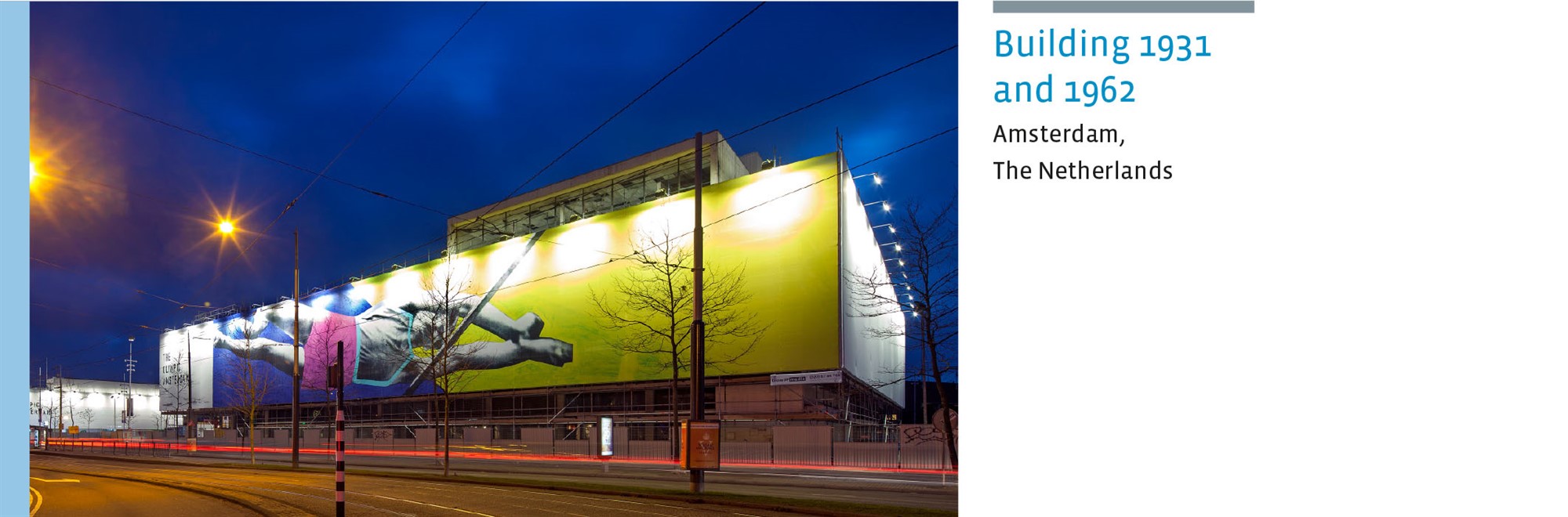

Building 1931 and Building 1962

Despite the fact that redevelopment activities have faced a number of challenges, such as foundation issues and delays to completion, the Fund once again benefited from positive revaluations. Yields are declining continuously and market rent levels are increasing. Distinctive assets such as Building 1931 and Building 1962 are attracting numerous potential tenants, which is helping the Fund to repeatedly increase rent levels. The current rent levels are among the highest in Amsterdam and thus for the Netherlands. Building 1931 is fully let to Pon Holdings. Pon plans to rename this single tenant building to 'MOVE', which symbolises the future mobility experience Pon plans to unveil. It also marks the relocation of their holding office to Amsterdam from Almere.

The permanent improvement of the entire area, which has been branded The Olympic Amsterdam, requires close cooperation between numerous stakeholders. The Fund took the initiative to meet with parties including real estate owners, users and the Amsterdam city council. This led to discussions on topics such as the lay-out and design of public spaces, the re-opening and branding of the assets and the site and the organisational structure of the area management. This has resulted in the installation of a preliminary foundation (to take charge of area management) and a conceptual investment plan and budget.

At the time of writing, negotiations for the remaining office spaces of approximately 2,500 m2 are pending.

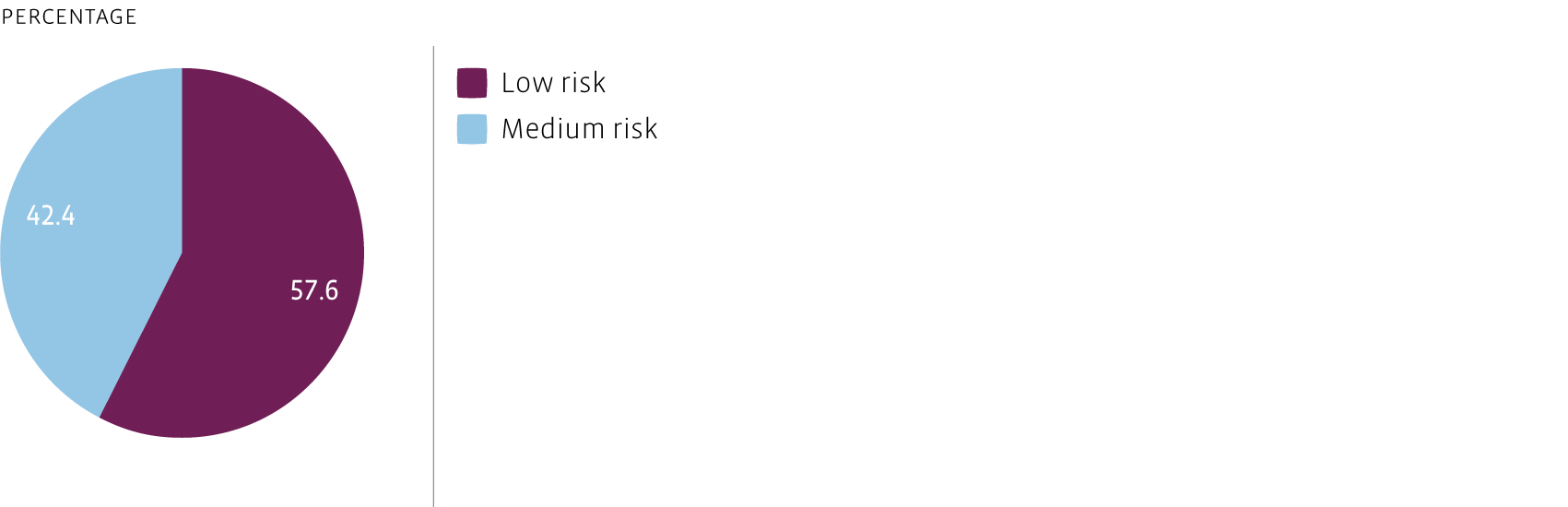

Risk-return profile

In terms of risk diversification, at least 90% of the investments must be low or medium risk. The actual risk allocation as at year-end 2017 is shown in the figure below. Every year, all properties are assessed separately. In 2017, the Fund was classified as 100% low to medium risk and as such was consistent with the framework of the Fund conditions.

Future investments related to WTC Rotterdam, Building 1931, Building 1962 and Hourglass in Amsterdam will further lower the risk profile of the Fund.

Portfolio composition by risk category based on market value

Portfolio diversification

At year-end 2017, the Fund's portfolio consisted of 14 Dutch office properties, 2 Dutch office redevelopment projects and 1 Dutch office development project.

Type of property

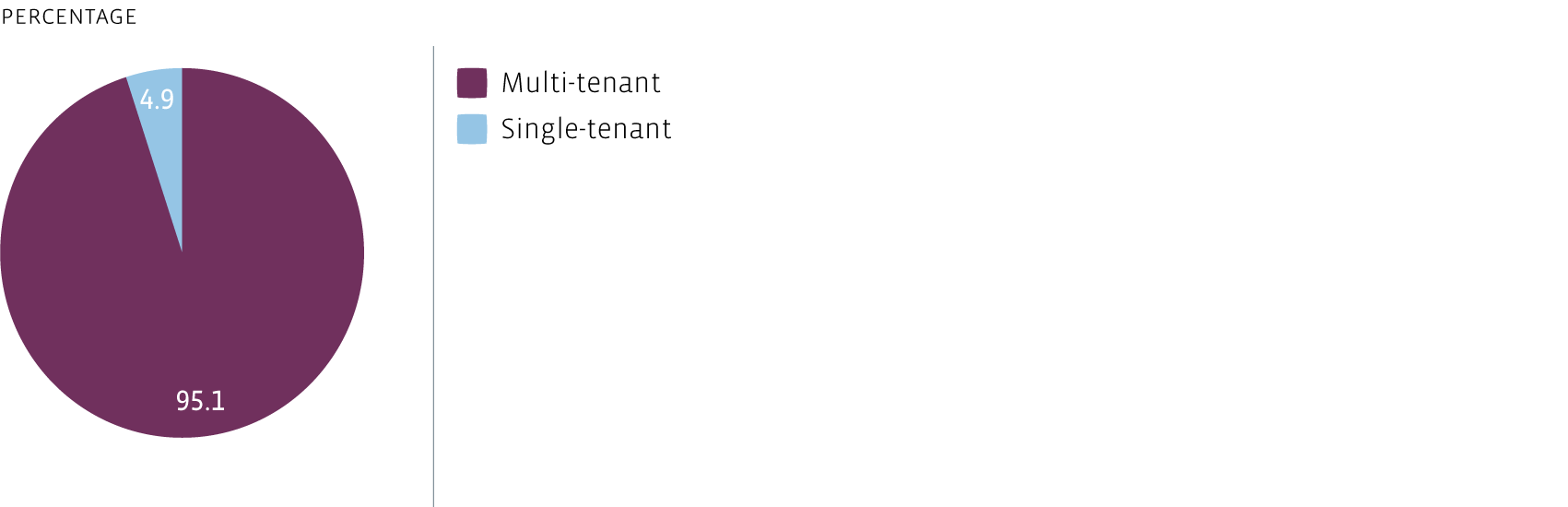

Multiple lease agreements reduce the volatility of revaluations and help increase the control of asset management risks. Furthermore, the Fund focuses on locations that attract a widely diverse group of people and offer a mix of culture, education, sport and work facilities.

The share of multi-tenant assets in the portfolio increased to 95.1% in 2017 (94.4% in 2016).

Portfolio composition by single vs multi-tenant based on market value

Core regions

To identify the most attractive municipalities for office investments, the Fund takes into account indicators such as:

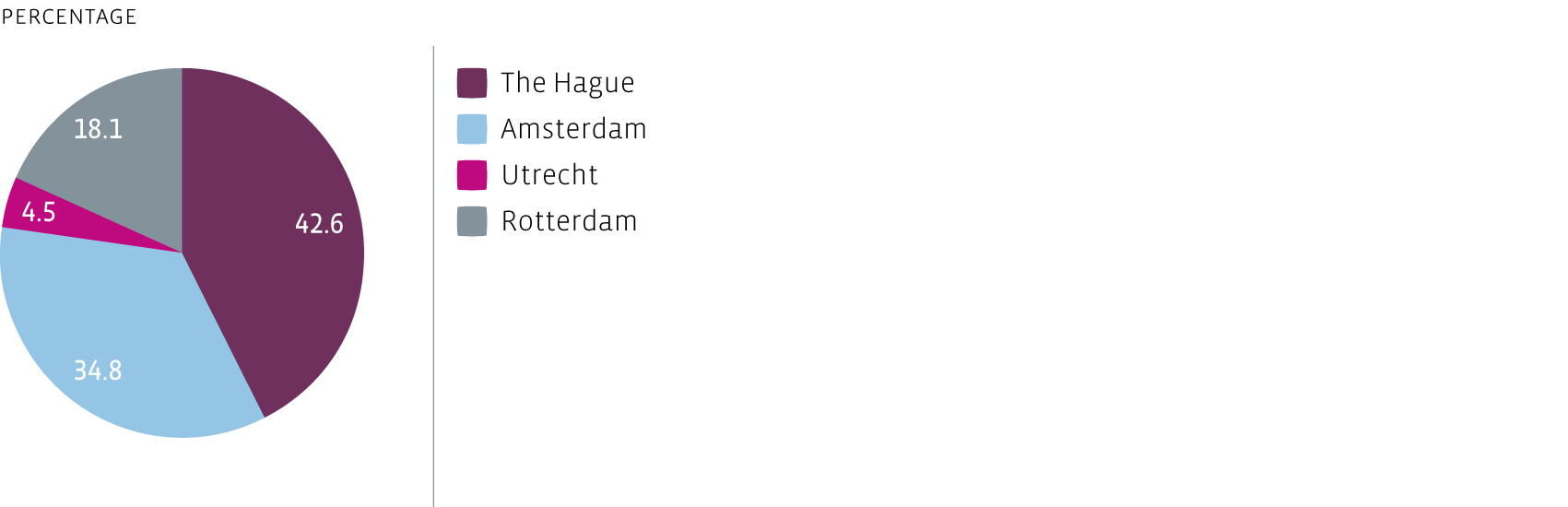

At year-end 2017, 100% of the Fund's assets were located in the four core regions; Amsterdam, Rotterdam, The Hague and Utrecht.

Both the project of Hourglass in Amsterdam, once completed, and the redevelopment of Building 1931 and Building 1962 in Amsterdam will improve diversification, reducing the share of the portfolio accounted for by The Hague in particular, and increasing the proportion of assets in the Dutch capital.

Portfolio composition by core region based on market value

Tenant mix

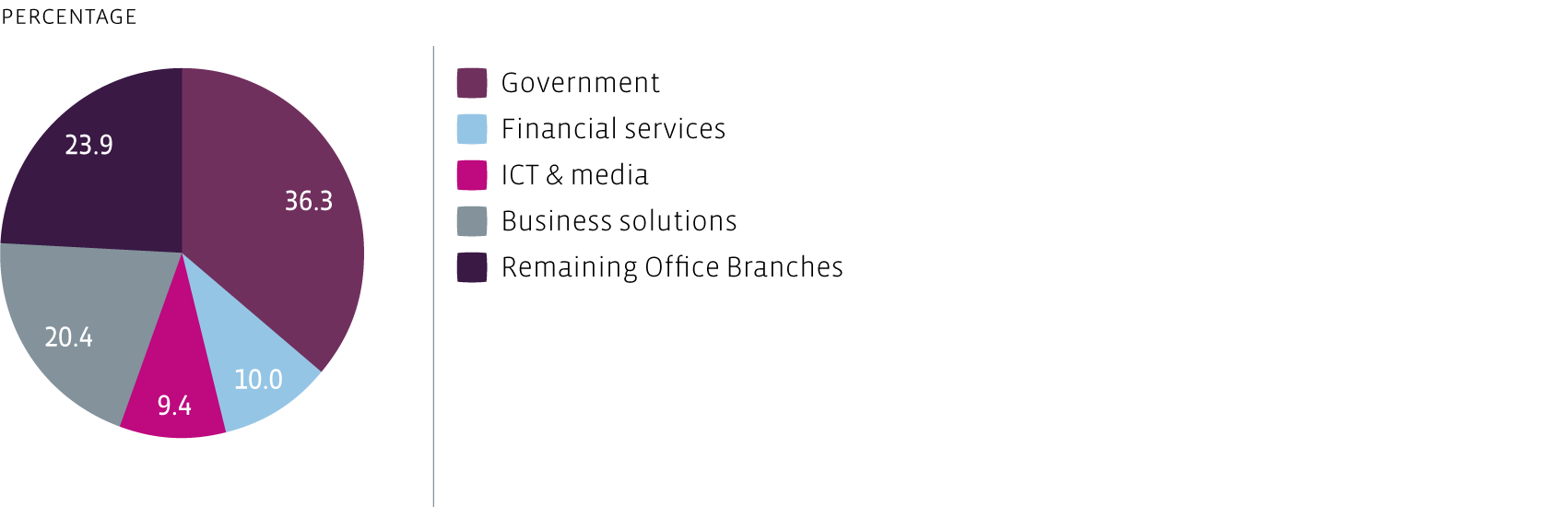

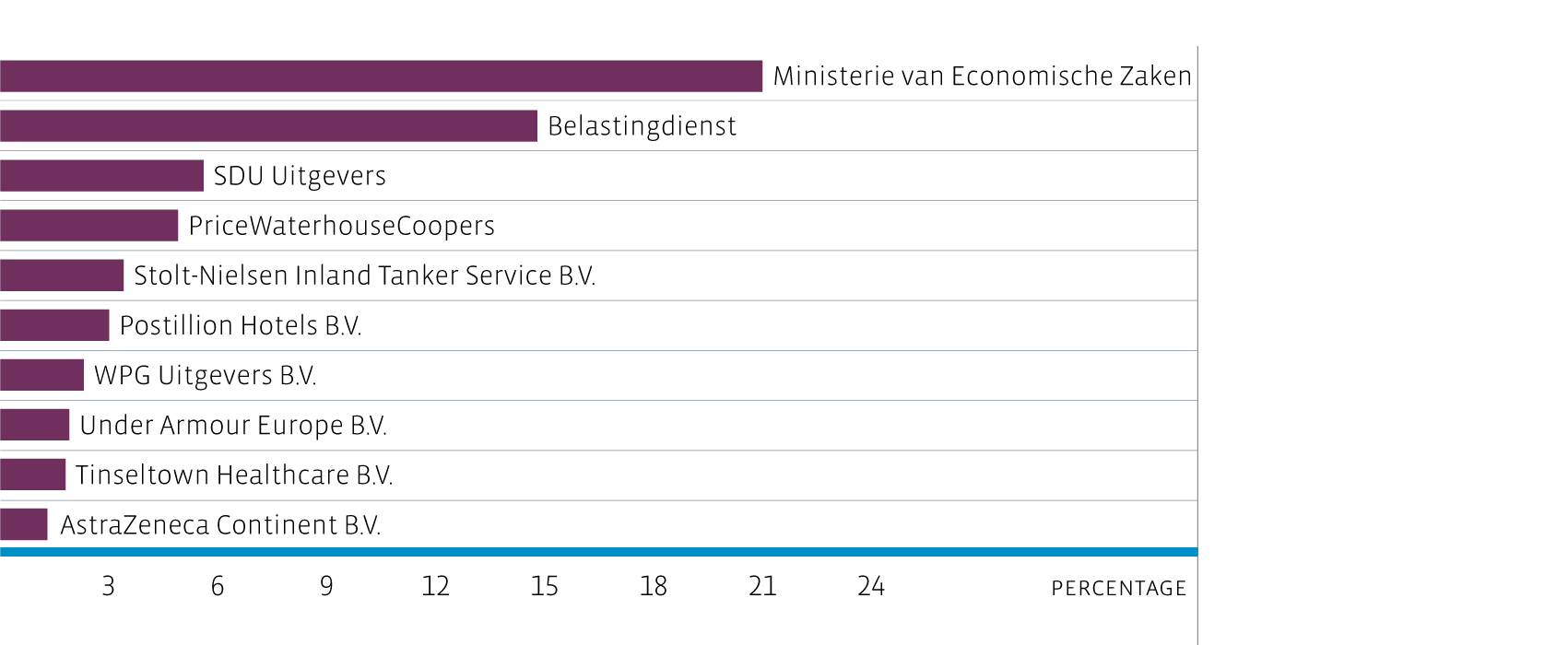

Most of the Fund's tenants are considered to have a low debtor's risk. The top ten tenants account for a total of 60.1% (2016: 62.8%) of the passing rent. The Fund negotiated leases with a number of new and existing tenants in 2017, closing leases for 21,296m² of office space and annual rent of € 3.9 million. We maintain close relationships with all our tenants to ensure satisfied customers.

Portfolio composition by tenant sector as a percentage of rental income

The Office Fund’s top 10 tenants

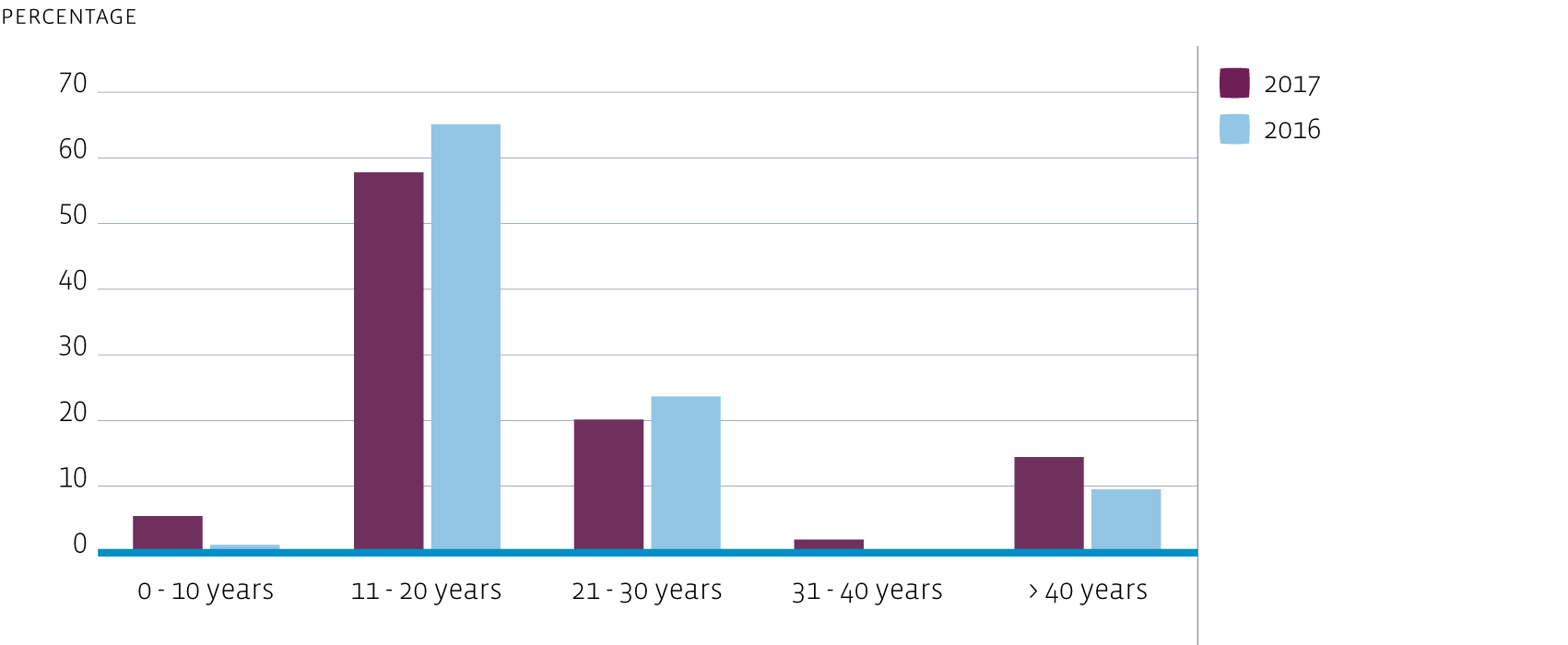

Age

More important than age is the asset's distinctive character, its location and return prognosis. Some assets have a listed status based on their rich history and architecture. The age of these assets increases the average age of the portfolio. However, the new-build, mixed-use Hourglass building in Amsterdam will reduce the average age of the portfolio from 2019 onwards.

Portfolio composition by age based on market value

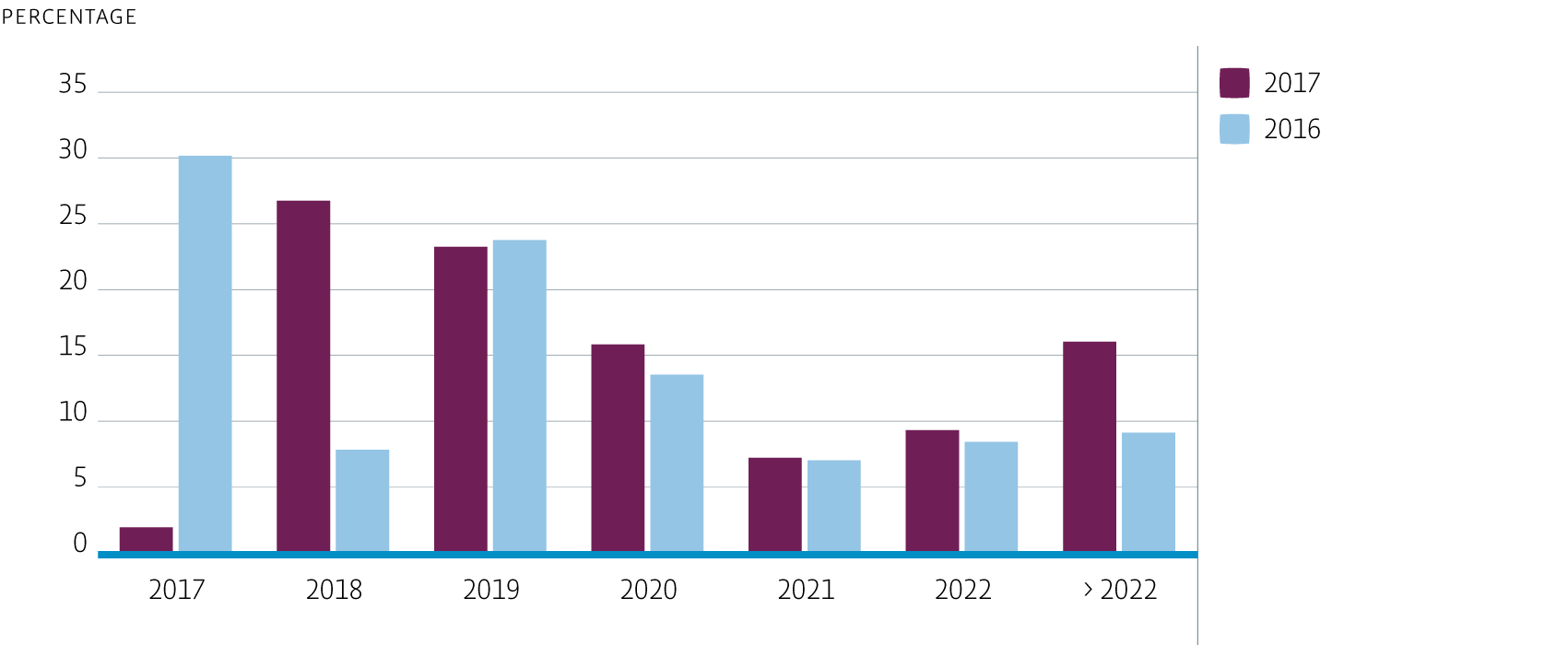

Expiry dates

The relatively high percentage of expiry dates in 2018 and 2019 is a result of the potential termination of leases with two large tenants. After the Ministry of Economic Affairs agreed a short-term extension of its lease for Centre Court in The Hague (31,277 m2) at the beginning of the year, the Central Government Real Estate Agency showed interest in a lease extension for a longer period. Negotiations with the Central Government Real Estate Agency on behalf of the Ministry of Economic Affairs in Centre Court (The Hague) have led to a lease extension in February 2018. This will shift the peak of 2018 to 2023. The average remaining lease term stood at 2.6 years at year end 2017 (excluding the lease extension for Centre Court). This is 0.2 less than the 2.8 years at year-end 2016.

Close relationships with tenants enable the Fund to propose lease extensions at the right time. However, lease endings are taken into account and the Fund anticipates this to attract new tenants.

Expiry dates as a percentage of rental income

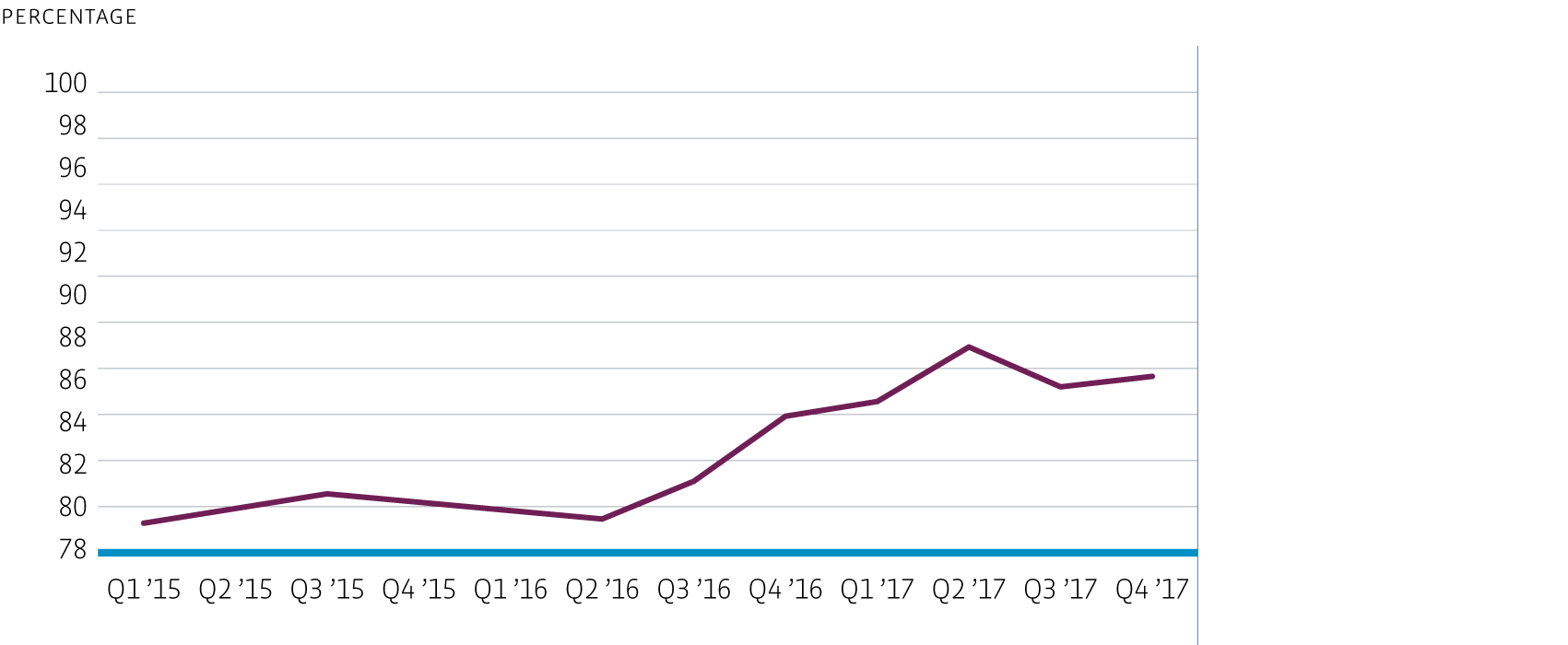

Financial occupancy

WTC Rotterdam and WTC The Hague have the largest negative impact on the Fund’s occupancy rate. The upgrade of WTC The Hague has visibly improved the dynamics of the central entrance hall. This has had a positive impact on building’s image and the experience of both visitors and tenants, and supported new leases. This has resulted in a steady stream of new lease transactions and resulted in an improvement in the financial occupancy rate for the building (2016: 75.5%, 2017: 82.7%).

At WTC Rotterdam, the renovation of several office floors has already resulted in new leases. However, the building’s image is largely determined by a visitor’s first impression when entering the building. The Fund’s investment plan will therefore prioritise the improvement of this first impression. We are making careful preparations for the execution of the plan. The listed status of the building means we are obliged to coordinate any changes with the Dutch National Cultural Heritage Agency (Rijksdienst voor Cultureel Erfgoed). The investments in this project will be made in phases. We started the refurbishment of the Main Hall in 2017 and this will continue in the years ahead.

New lettings for Nieuwe Vaart in Utrecht, which ran parallel with various capital expenditure projects also contributed to an increase of the occupancy rate in 2017.

Financial occupancy rate