Focus on material topics

The Office Fund's sustainability strategy is focused on reducing the environmental impact of the office assets in its portfolio. It does this by exerting a direct influence on the larger (public) areas of the buildings or complexes, and by investing in improvements that benefit existing and potential tenants. The Fund actively cooperates with existing tenants and potential tenants on initiatives to optimise comfort and energy efficiency. We also work closely with external property managers to provide comfortable, safe and convenient office and public spaces in assets.

Monitoring performance

Monitoring environmental performance data (energy and water consumption, greenhouse gas emissions and waste) is an important part of managing sustainability issues. The Fund tracks and aims to improve the environmental performance of its managed real estate assets: those properties for which the Fund is responsible for purchasing and managing energy consumption. The Fund reports on energy consumption (electricity, heating and gas: the energy components) for multi-tenant assets, which translates to greenhouse gas emissions.

The Fund has set clear targets for the reduction of its environmental impact in the period 2017-2018:

Energy: average annual reduction 2%

GHG emissions: average annual reduction 2%

Water: average annual reduction 2%

Waste: increase recycling percentage

Renewable energy: increase percentage of renewable energy

Energy

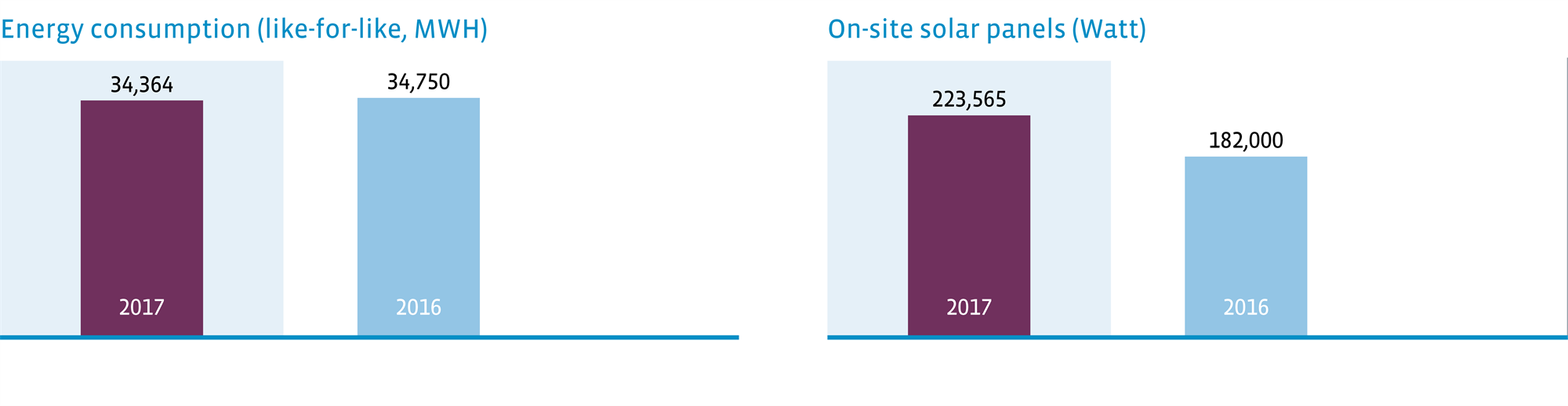

In 2017, the Fund managed to cut energy consumption by 1.1% (2016: 4.8%) on a like-for-like basis.

Environmental impact

Water and waste

The Fund has been actively tracking water consumption in multi-tenant assets since 2012. Data is provided by the property manager and is based on invoices and manual visual readings. The Fund tracked waste management for its entire managed real estate portfolio in 2017. The focus is on those assets for which the Fund is responsible and can influence the waste handling on-site and generally involves multi-tenant office assets. No waste is sent directly to landfill.

Performance indicators

The Fund’s ambition to increase the coverage and transparency of its environmental impact according to INREV sustainability guidelines is reflected in the summary of key ESG data. For more detailed information, please see the Responsible investing performance indicators at the end of this annual report.

Smart offices

Environmental and Energy Monitoring Systems enable building owners and managers to actively monitor building data. Gaining more insight into this data helps the Fund to continually improve the performance of its assets. In 2017, the Fund started a pilot with Simaxx in WTC Rotterdam. Monitoring the operation of installations helps to improve the indoor air quality and reduce energy use. This optimisation of operating processes within buildings will help us to reduce the total carbon footprint of the Fund. It is also helping us to make the shift from visual maintenance to data-driven and predictive maintenance to cut costs.

In 2017, we initiated a collaboration with Nuuka, a building process analytics software company. The Nuuka tool makes buildings smart, leading to improved efficiency, security, and environmental performance. We have started a pilot project with Nuuka in WTC The Hague and Nieuwe Vaart (Utrecht). The Nuuka system will help us to improve our insight into the environmental footprint of the assets in our portfolio. If these pilots are successful, we will apply both systems across the entire portfolio to improve our sustainable asset management.