Portfolio composition at year-end 2017:

Investments, divestments and redevelopments

Following the completion of the Damrak and Nieuwendijk redevelopments in Amsterdam at the end of 2016, in 2017 the Fund continued to work on the optimisation of its retail portfolio. In this chapter, we describe how new acquisitions, divestments and investments in standing assets have contributed to this portfolio optimisation.

Investments

The Fund invested a total of € 77 million in new turn-key acquisitions and investments in standing assets, which was slightly below the budget of € 90 million. The investments helped take the total value of the portfolio to € 877 million at the end of 2017. Of the total acquisitions, € 8 million was in line with our Experience strategy, while € 69 million was invested in line with our Convenience strategy.

New assets in the portfolio

Slangenbeek shopping centre, Hengelo

The Slangenbeek shopping centre comprises 11 retail units, including two supermarkets, Albert Heijn en Dirk van de Broek. The 3,862-m² centre also has several local businesses (including a hairdresser, a baker, a cheese store and a florist) and a national retailer, Kruidvat. The centre has around 330 parking spots on the adjacent parking lot. The shopping centre is 100% let and the average remaining term on the lease contacts is 5.6 years. The shopping centre has a healthy catchment area, anchored by dominant supermarkets, with good parking facilities and a retail mix focused on daily shopping.

Oosterheem shopping centre, Zoetermeer

The 12,000-m² Oosterheem shopping centre includes 38 retail units and focuses on shopping for daily goods. Anchored by three modern supermarkets (Jumbo, Aldi and Hoogvliet), local and national retailers, including Hema, Blokker and Zeeman, a central location in the neighbourhood and its own parking for 230 cars, the centre offers all the convenience the Fund demands.

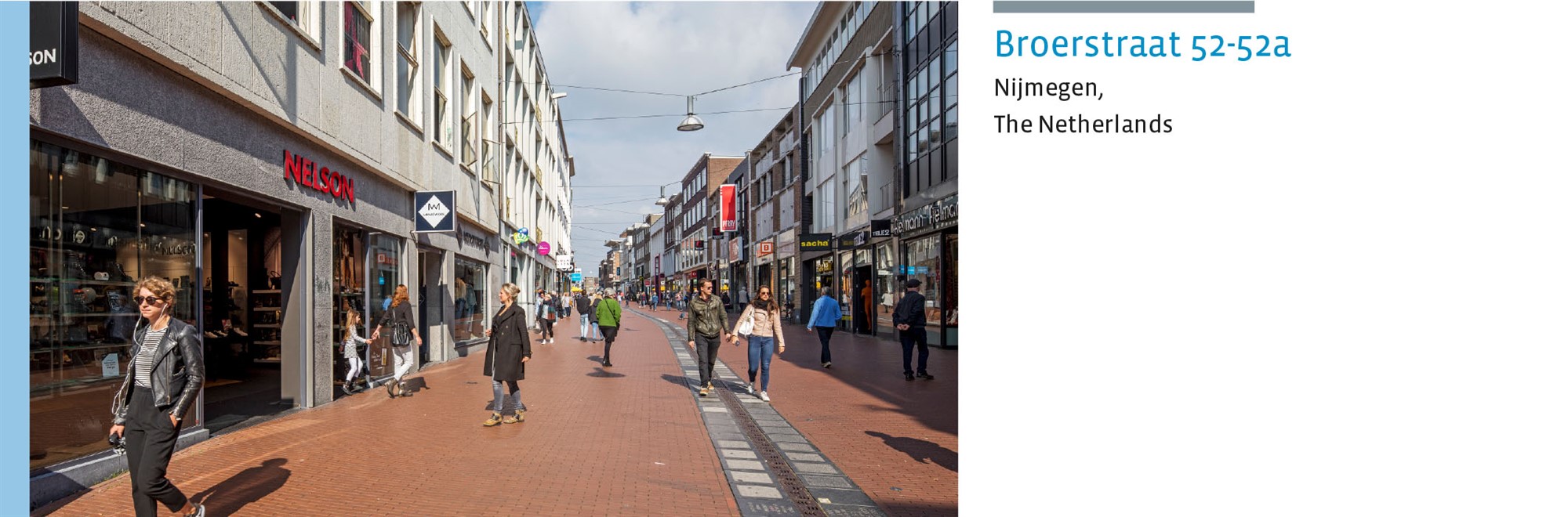

Broerstraat 52 and 52a, Nijmegen

The Fund acquired two high street units in the Broerstraat, the busiest shopping street in Nijmegen. The units are rented by retailer Men at Work B.V. and Nelson Schoenen B.V. and includes 613 m² of leasable area on the ground floor and a 500-m² basement area. Nijmegen is among the Top-10 most attractive Dutch cities for shopping, so the acquisition is fully in line with the ‘Experience’ element of the Retail Fund’s strategy.

Completed redevelopments

Molenhoek shopping centre, Rosmalen

The completed redevelopment of Molenhoek has given a major boost to this successful shopping centre for daily goods. This asset is now completely future-proof, with new facades, the expansion of the existing tenant Albert Heijn (500 m²), a major upgrade of the look and feel of the centre, as well as improvements to the accessibility and an increase in the number of parking spaces, after which the footfall rose sharply by 23%. In addition, the redevelopment led to a strong improvement in the green energy label of this asset to label A from label G.

Redevelopment investments

Goverwelle shopping centre, Gouda

The Fund is investing in the upgrade and expansion of the Goverwelle shopping centre. The 1,000-m² extension will create space for the expansion of the Albert Heijn supermarket and for the addition of a second, complementary discount supermarket, plus additional parking facilities for 235 cars. Completion of this redevelopment is expected in 2018.

Muntpassage shopping centre, Weert

In 2017, the Fund reached agreement on an upgrade of the De Munt shopping centre in Weert, involving cosmetic improvements, fire safety measures and the improvement of the centre’s lettability. The Fund is currently evaluating a potential upgrade of the Muntpassage shopping centre in combination with the letting of 3,500 m2 of vacant retail space following the bankruptcy of former tenant V&D. As part of this evaluation, the Fund is currently in negotiations with several retailers for units in the renovated shopping centre. We expect to complete this redevelopment in 2018.

Secured pipeline

Centrumplan, Rosmalen

The investment Centrumplan in Rosmalen includes the acquisition of 17 retail units with a combined size of around 6,800 m2, which will form the expansion and completion of the current Rosmalen shopping centre. Construction was started in 2017 and delivery is expected in the second quarter of 2018. The expected total annual rental income for the entire plan is estimated at around € 1.4 million upon delivery.

The main anchors are two supermarkets: Jumbo (around 2,000 m2) and Lidl (around 1,800 m2), together with a number of daily grocery units. In addition, national retailers such as Kruidvat and HEMA are set to open stores in this new city centre area, together with a brasserie located in a historical building. The average term of the contracts already signed is around 8.3 years from delivery.

This investment is a good fit with the ‘Convenience’ element of the Fund’s strategy, which includes investments in local shopping centres with a healthy catchment area, anchored by supermarkets, with ample parking facilities and a retail mix geared towards daily shopping needs.

Divestments

In 2017, the Fund budgeted € 25 million for the divestment of non-prime assets. These assets do not fit our strategic requirements due to their location, size or economic outlook. In 2017, the Fund sold one high street asset in Breda (€ 0.6 million) with € 0.1 million profit. The remaining sales are expected in the first half of 2018.

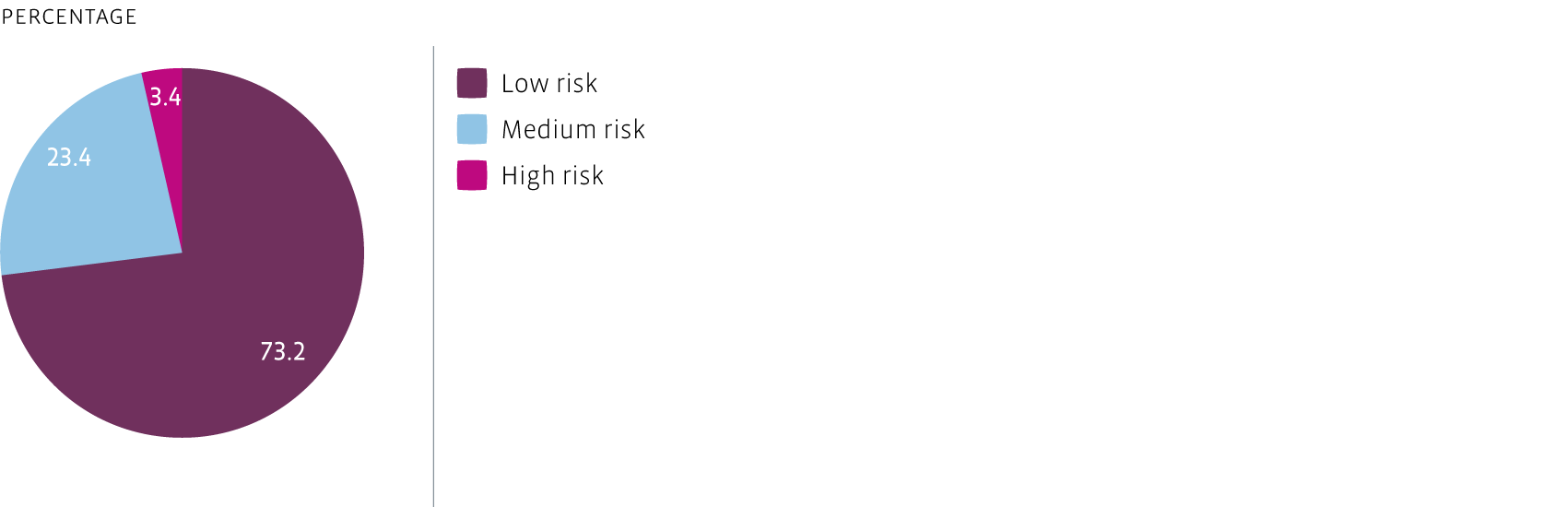

Risk-return profile

In terms of risk diversification, at least 90% of the investments must be low or medium risk. The actual risk allocation as at year-end 2017 is shown in the figure below. Every year, all properties are assessed separately.

Portfolio composition by risk category based on market value

Portfolio diversification

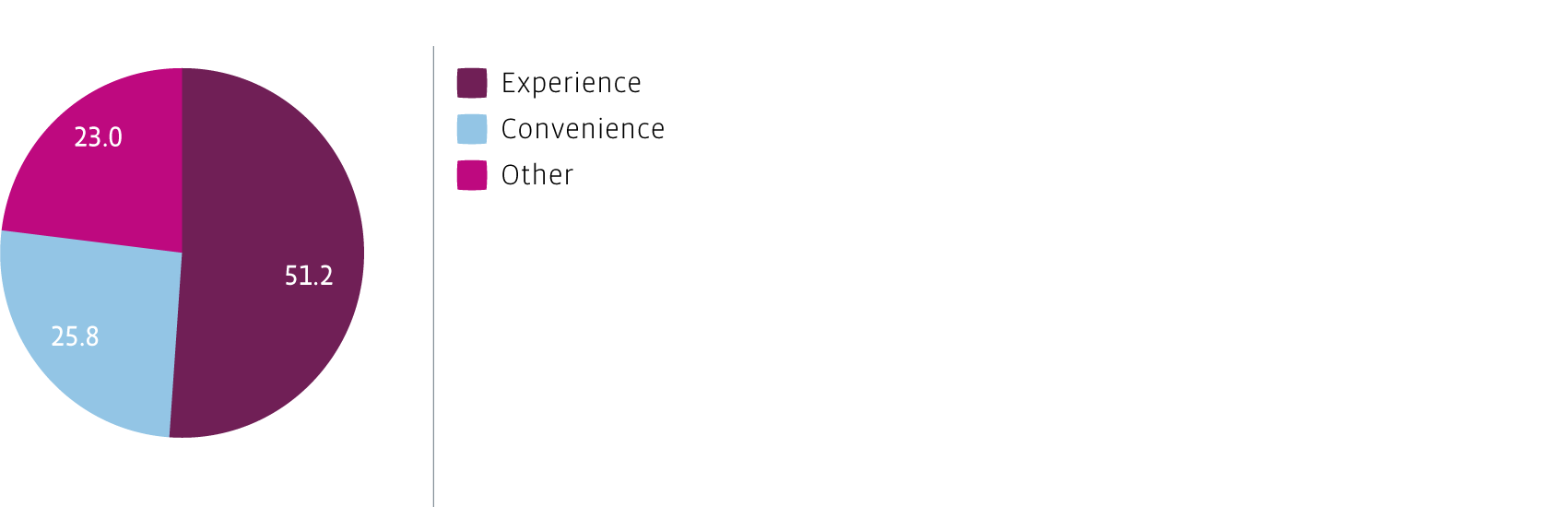

At year-end 2017, the Fund's total portfolio consisted of a total of 49 assets. Of these, 28 assets are classified as Experience and 11 assets are classified as Convenience The category ‘Other’ consists of 10 retail assets that do not fully meet our strict Experience and Convenience criteria.

Major segments

The Fund’s diversification strategy is based on the belief that the future of retail real estate will be determined by two very distinct segments of the market: high street shopping areas that offer consumers a distinctive Experience and district shopping centres or stand-alone supermarkets that provide very high levels of Convenience.

The Fund's ambition is to increase the share of Experience and Convenience to at least 80% of the portfolio value. In line with this ambition, in 2017, the Fund realised a 4.3%-point increase in the share of Experience and Convenience, which rose to 77.0% from 72.7%.

Portfolio composition by segment as a percentage of market value

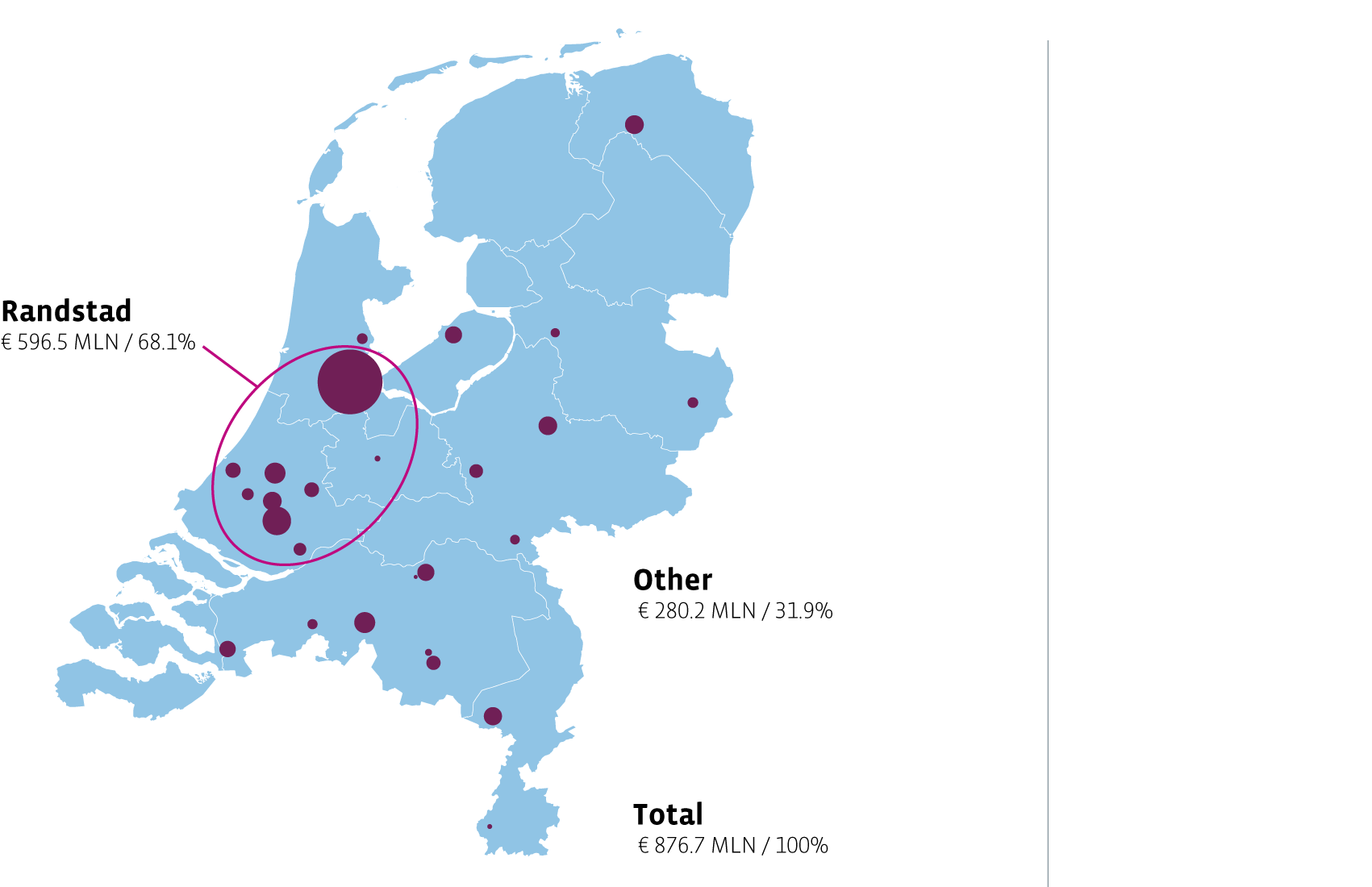

Regional spread of the Retail Fund portfolio based on market value

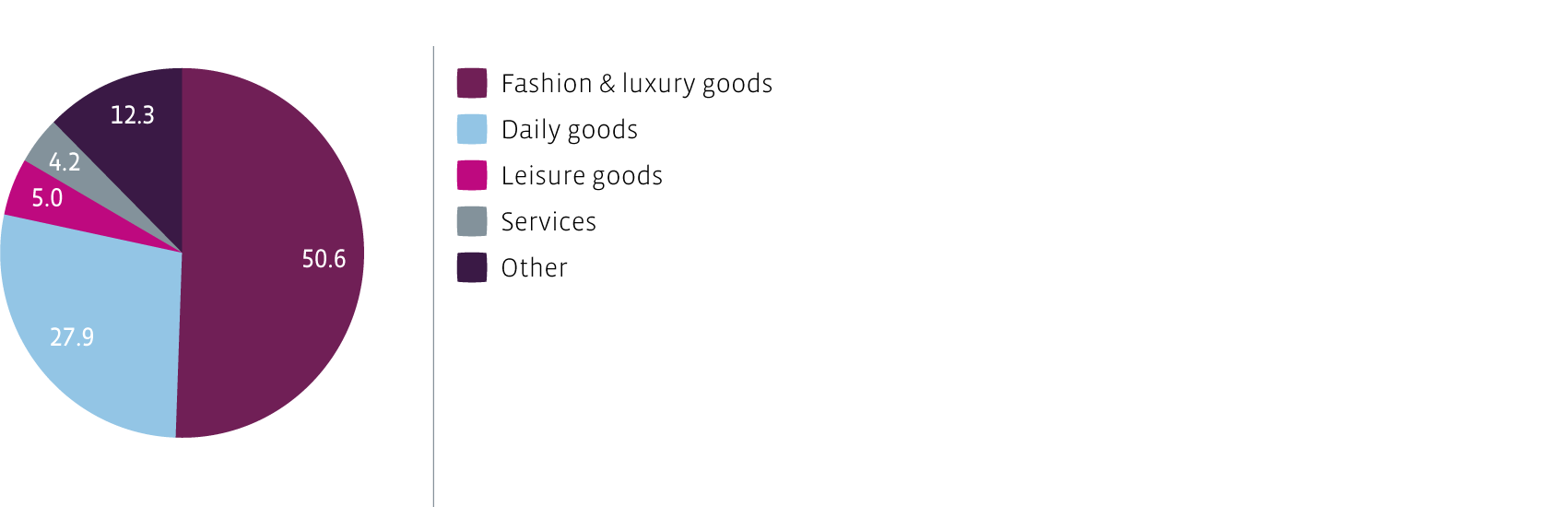

Tenant mix

The Fund’s portfolio includes a wide range of tenants by segment type. In 2017, the share of the segment 'daily goods' increased by 1.1% to 27.9% of the total portfolio through the acquisitions of the Slangenbeek and Oosterheem shopping centres. The share of the segment 'fashion and luxury goods' decreased by 2.6% to 50.6%.

Portfolio composition by tenant sector as a percentage of rental income

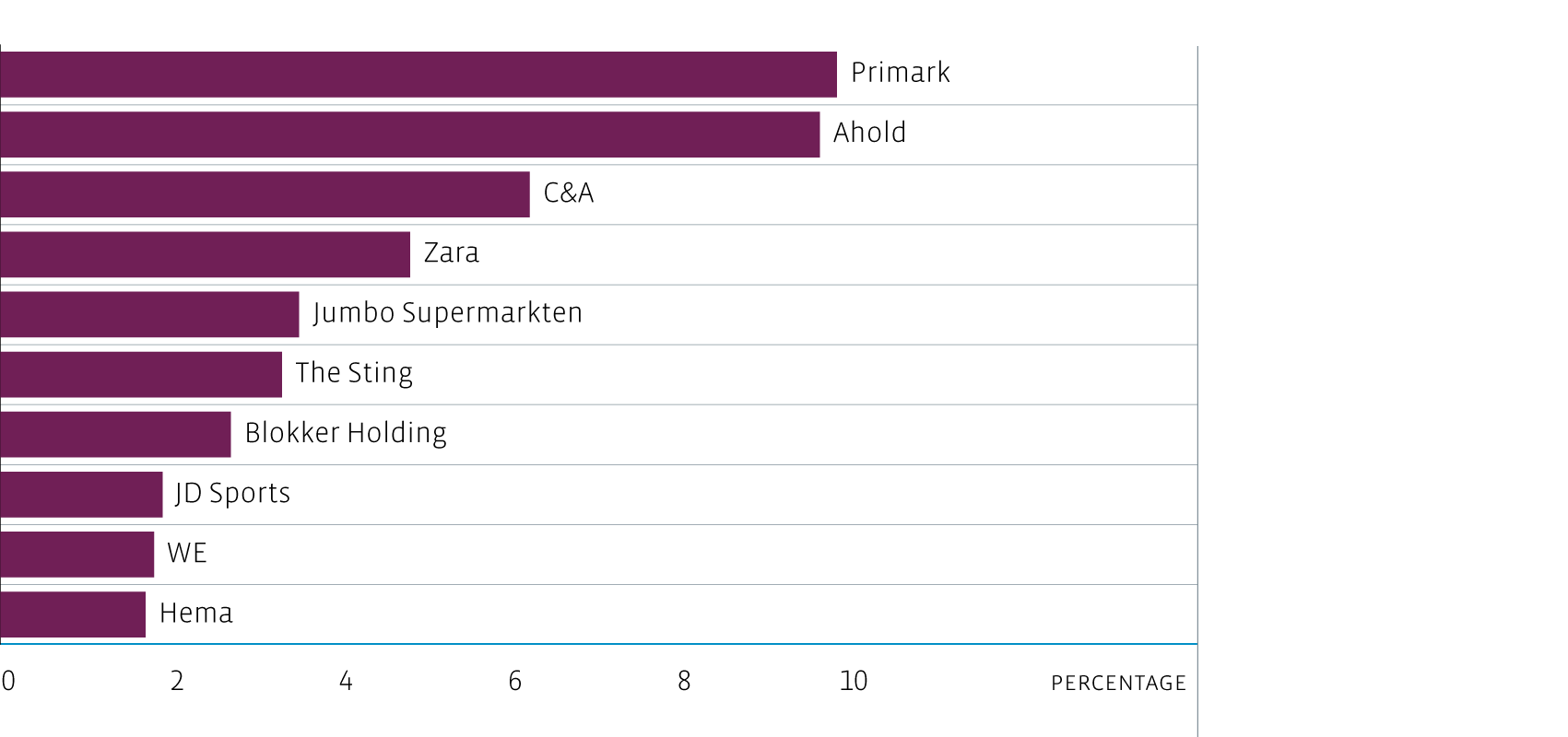

Top 10 tenants

The top ten tenants accounted for a total volume of 45.3% of the theoretical rent in 2017 (2016: 47.5%). The ranking changed slightly, mainly due to the acquisitions. Primark still tops the list, accounting for 9.8% of the Fund's total rental income. Jumbo Supermarkten rose from sixth to fifth place. Hema also rose to tenth place due to new leases in the Prinsenland shopping centre in Rotterdam and the Oosterheem shopping centre in Zoetermeer.

Top 10 major tenants based on theoretical rent

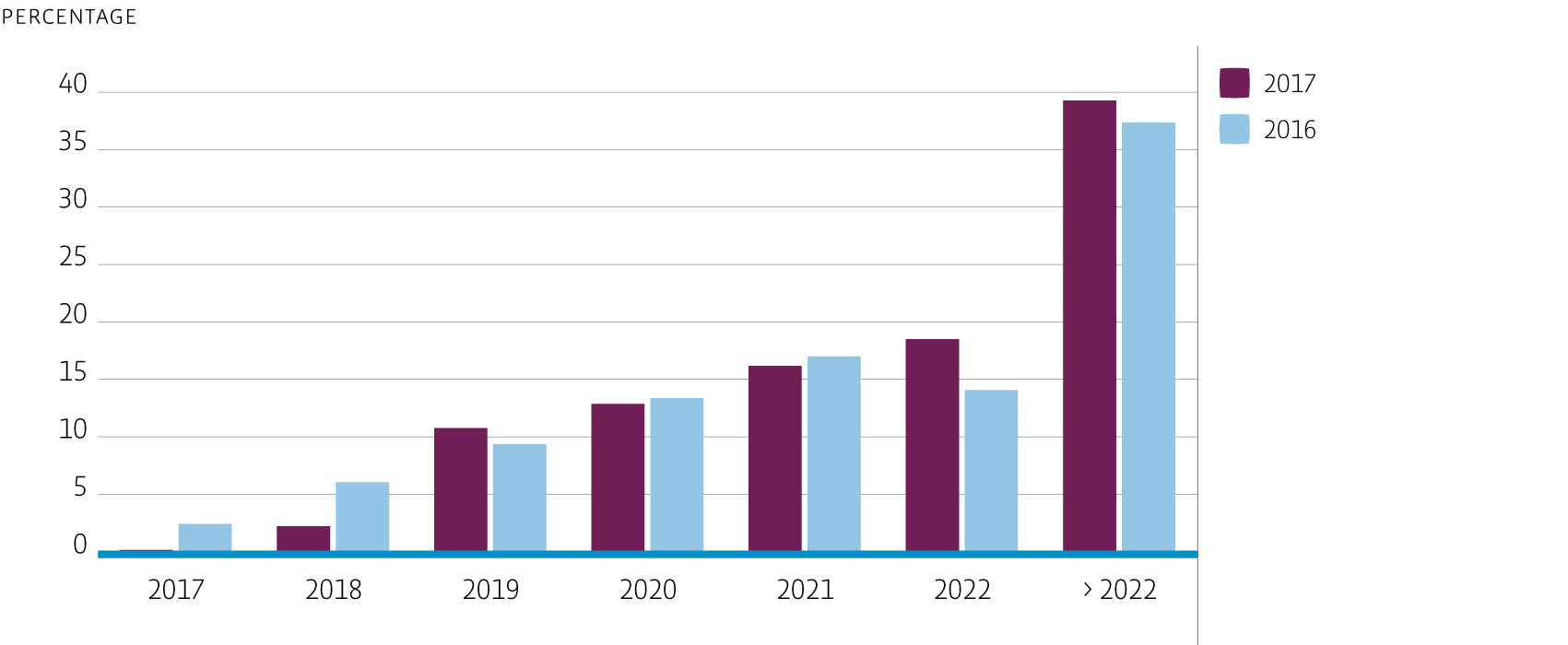

Expiry dates

The overview of expiry dates shows a gradual division in the coming years. By the end of 2017, more than 39.2% of the total rental income was due to expire after 2022, which means the Fund’s expiration risk remains very low. The average remaining lease term of the total portfolio at year-end 2017 is 6.5 years.

Expiry dates as a percentage of rental income

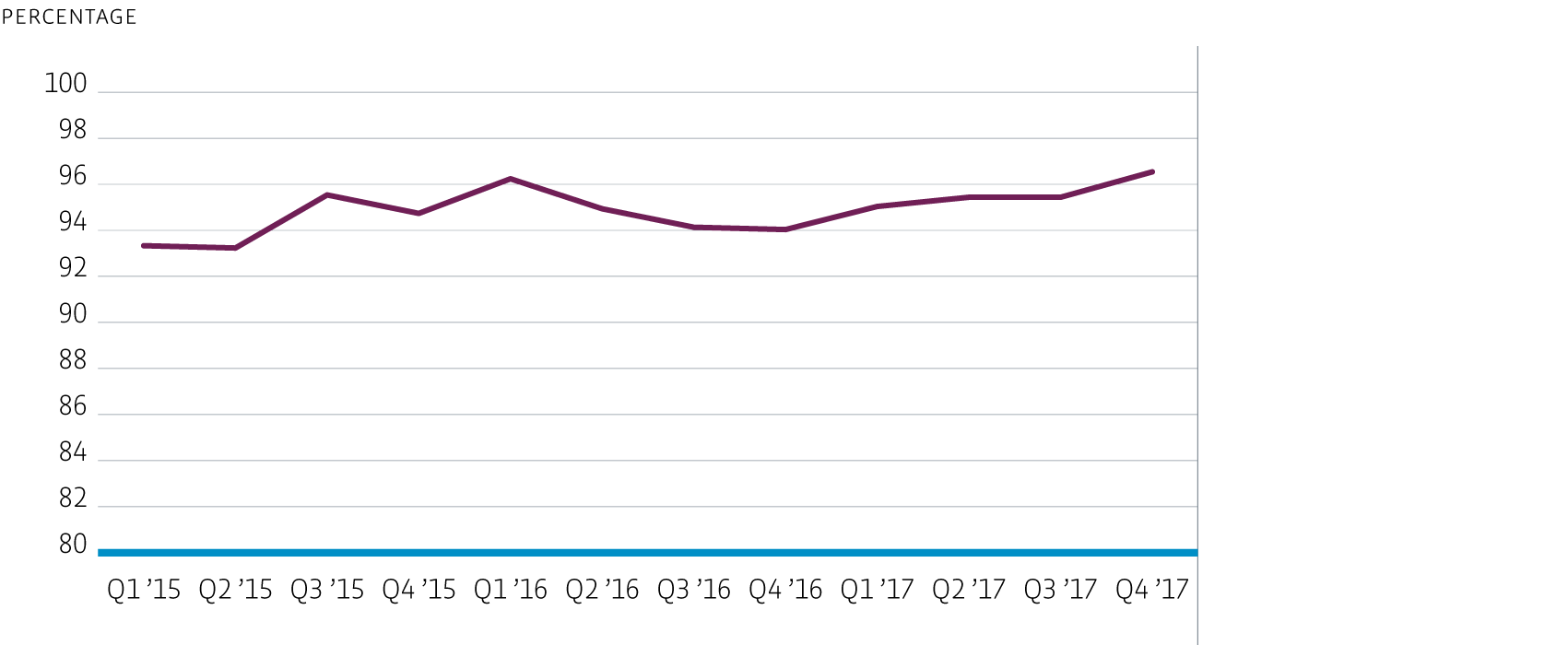

Financial occupancy

The Fund managed to increase the average occupancy rate up to 95.6% in 2017 (94.7% in 2016), which was 0.7% better than the 2017 budget. Although we saw an increase in the occupancy rate at a large number of assets in the portfolio, the new Mosveld shopping centre (13.0% increase to 86.4%) and the Stadionplein shopping centre in Amsterdam (19.4% increase to 96.2%) made the largest contribution to the higher occupancy rate.

Financial occupancy rate