Global goals and challenges

The Paris Climate Agreement (COP21), the United Nations 2030 agenda for sustainable development and the Dutch Energy Agreement all marked the start of the race to curb global greenhouse gas (GHG) emissions in order to keep the global temperature rise below 2 degrees Celsius by 2050. At that point, all major business sectors should be operating in what will essentially be a zero carbon emission environment.

The built environment consumes around 40% of the world’s energy and accounts for up to 30% of the world’s annual GHG emissions. Additionally, the building industry accounts for a large proportion of global raw materials use. As a company that invests in real estate at a global level, we therefore feel obliged to play a role in finding solutions to the challenges we all face. What this means in concrete terms is that we want to contribute to the realisation of a CO2 neutral, sustainable and healthy living environment.

Our approach

Bouwinvest aims to provide a solid return on real estate investments for institutional investors and their beneficiaries. And because we invest for the long term, we do this in a responsible manner. What this means is that environmental, social and corporate governance (ESG) criteria play a significant role in our business operations.

By applying these ESG criteria to our business operations, we want to create an environment in which each and every employee in our organisation accepts responsibility for the impact their actions have on the environment and on society as a whole. Our main priority on this front is to reduce our negative impact on the environment and society.

With responsible investment we mean the inclusion of environmental, social and governance (ESG) criteria in our investment decisions. And we do this to generate sustainable returns for the long term, in line with the United Nations’ Principles for Responsible Investment (UN PRI). This will enable us to create a future-proof and sustainable real estate portfolio, which is essential to an investor with a long-term view such as Bouwinvest.

Sustainability goals

Bouwinvest once again sharpened the definition of its sustainability goals in 2017. In addition to the long-term returns for our clients, we also want our real estate investments to make a contribution to finding solutions for the social and environmental challenges we face. As part of this mission, by 2020 we want at least 70% of our assets under management to score above-average on the sustainability front (GRESB 4 or 5 stars) and to make a positive contribution to the United Nations’ sustainable development goals. These goals pertain to sustainable cities, affordable and clean energy, health and well-being, climate change and other social challenges, with 2030 set as the horizon. Bouwinvest uses these goals to translate its responsible investment strategy into concrete actions.

Corporate Responsibility: strategy and progress

We see corporate responsibility as much more than simply complying with minimum laws and regulations. CSR plays a role in every decision we take and choices we make. This does of course create dilemmas, as we have to make decisions in that area of conflict between financial profit and social profit. The challenge for us is to meet our duty to act according to the principle of corporate responsibility in a way that is appropriate for Bouwinvest, that responds to the expectations of our stakeholders and creates added social value. Our strategy is focused on reducing the environmental impact of the management organisation, increasing employee satisfaction and engagement, community engagement, sponsoring and ESG governance.

Reducing our environmental impact

The management organisation is also working on the reduction of its environmental impact. We have reached agreement with the owner of the Bouwinvest head office in Amsterdam on adjustments to the building’s shell and improvements to the climate installations. Together with the owner, we are aiming to achieve BREEAM In-Use good certification and energy label A/B. Last year, we also replaced our car lease scheme with a mobility scheme. The aim of this is to stimulate the use of alternative forms of mobility, plus we have set a maximum limit on the CO2 emissions of our lease cars. Despite these and other measures, we recorded a slight increase in our absolute CO2 emissions in 2017, which were 0.4% higher at 551 tonnes CO2e. The emission-intensity, expressed in tonnes CO2e/FTE, did fall by 10% to 3.6 tonnes CO2e/FTE/year.

Employees

Bouwinvest employees are extremely important to the company. Every two years, we conduct an employee survey, with the aim of achieving a score higher than 7. In last year’s employee survey, Bouwinvest scored an average of 8. This above-average score puts us in the top three of the financial services group in the Effectory label.

Community engagement and sponsoring

We actively encourage the social engagement of our employees and we sponsor various social initiatives. Last year, we sponsored Dutch Green Building Week and we extended our sustainable partnership with Homeplan for another three years. Bouwinvest is a member of a number of industry associations and sustainability initiatives. Our employees actively participate in or manage work groups organised by ULI, GRESB, DGBC, FSC Nederland, ANREV, INREV and the IVBN.

ESG governance

In 2017, Bouwinvest set up the CSR & Innovation department and added a new FTE. This department has been assigned the task of strengthening the corporate and investment sustainability within the organisation. Following the expansion of the department, we have given it a permanent advisory position on the internal investment committee.

Dialogue with stakeholders

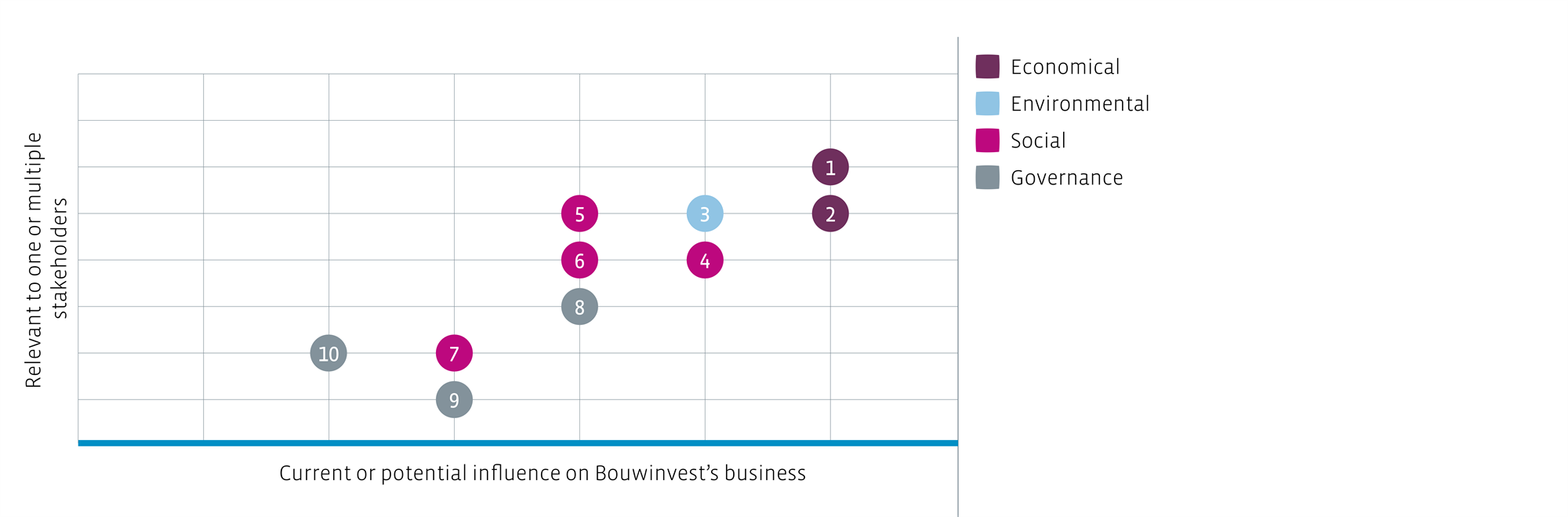

The trust of our stakeholders serves as the basis for Bouwinvest’s business operations. This is about cooperation, integrity, honesty and corporate responsibility. These are fundamental conditions for achieving optimum returns for our stakeholders. In 2017, we conducted an analysis to define and map out the interests of investors, shareholders, national and local government organisations, business partners (building firms / developers), local operators, regulatory bodies, tenants and employees. On the basis of this analysis, we drew up a materiality matrix. The table and graph below show the aspects Bouwinvest believes are relevant to one or more stakeholders (y-axis) and that may have an impact on Bouwinvest’s current or future business operations (x-axis). We have added the detailed table in the appendix. Next year, we plan to initiate a dialogue with our stakeholders on these materiality aspects.

Materiality matrix

Economical: | | Environmental: | |

1 | Long term return on real estate investments | 3 | Sustainable real estate investments |

2 | Growth of real estate investments | | |

Social: | | Governance: | |

4 | Tenant and investor services and engagement | 8 | Thought leadership & reputation |

5 | Careers & employment | 9 | Protection of privacy |

6 | Stand-out employer | 10 | Responsible business practices |

7 | Partnerships & long term commitment | | |

Responsible investment: strategy and progress

The responsible investment strategy of our five Dutch real estate funds is built on three pillars: Fund & Asset Sustainability, Community & Stakeholder Engagement and Environmental impact.

Sustainable real estate funds and buildings contribute to the fight against climate change and in addition to this generate broader social, economic, environmental and health benefits. We are convinced that our approach reduces risks, raises returns for our clients and increases the attractiveness and lettability of our real estate assets. Our efforts on the responsible and sustainable investment front were recognised with an award at the international BREEAM Award Festival.

In 2017, we made progress on the following fronts:

Responsible investment strategy | Category | Result 2017 |

Improved sustainability performance of funds and building | Fund/ mandate | 96% of the Dutch funds had GRESB 4/5-star ratings in 2017 (2016: 25%) |

34% of the investments in the international mandates had a GRESB 4/5-star rating in 2017 (2016: 20%). |

The Dutch funds had an average GRESB score of 74 points in 2017, an improvement of 7 points compared with 2016. |

The average GRESB score of the international mandates in 2017 (73 points ) was 12 points higher than in the previous year and was 10 points higher than the GRESB worldwide average in 2017 (63 points)* |

Just as they did in 2016, 100% of the Dutch funds participated in the GRESB survey. |

72% of the investments in the international mandates (based on invested capital) participated in the GRESB survey. This was the same as in 2016. |

Building | 31% of the surface area included in the Dutch funds is covered by sustainable building certificates and 93% has a green energy label (A, B or C). |

The international mandates scored an average of 54 points on the component sustainable building certificates in the GRESB survey. This is 8 points higher than the worldwide average.* |

Improved stakeholder engagement | People | The tenants in the buildings of the Dutch funds gave Bouwinvest an average score of 6.7. |

83% of the international investments conducted a tenant satisfaction survey. The worldwide GRESB average came in at 70%. * |

Reduction of environmental impact | Environment | The energy consumption of the Dutch open funds was 1.8% lower than in 2016 (like-for-like). |

Within the international mandates, energy consumption was down by 2.7% compared with the previous year * |

The buildings in the Dutch funds were fitted with solar panels adding up to 2.2 megawatt peak. This was an increase of 1.6 megawatt peak compared with 2016. |

14% of the energy consumption of the international investments was generated from renewable sources* |

*Results of the most recent GRESB benchmark 2017