Sustainability performance at Fund level

Benchmarking based on GRESB enables the Office Fund to improve the sustainability of the Fund. It enables us to report the performance and targets within our assets on a regular basis. We evaluate the ESG performance of the fund annually using the GRESB tool. This enables us to add new targets or actions following the assessment.

In 2014, the Fund was awarded Green Star status in the annual GRESB assessment. The Fund has retained this status to this day. GRESB introduced a new star-rating since 2016, which is based on the GRESB score and its quintile position relative to the GRESB universe. The Fund was awarded a five-star status in 2016 (on a scale of 1-5, which puts the Fund in the 20% best-performing funds worldwide). The target for 2017 was to retain this status and to improve the overall score. The Fund achieved both targets; the overall score increased to 86 in 2017 from 78 the previous year and the Fund was once again awarded five-star status.

Sustainability performance at asset level

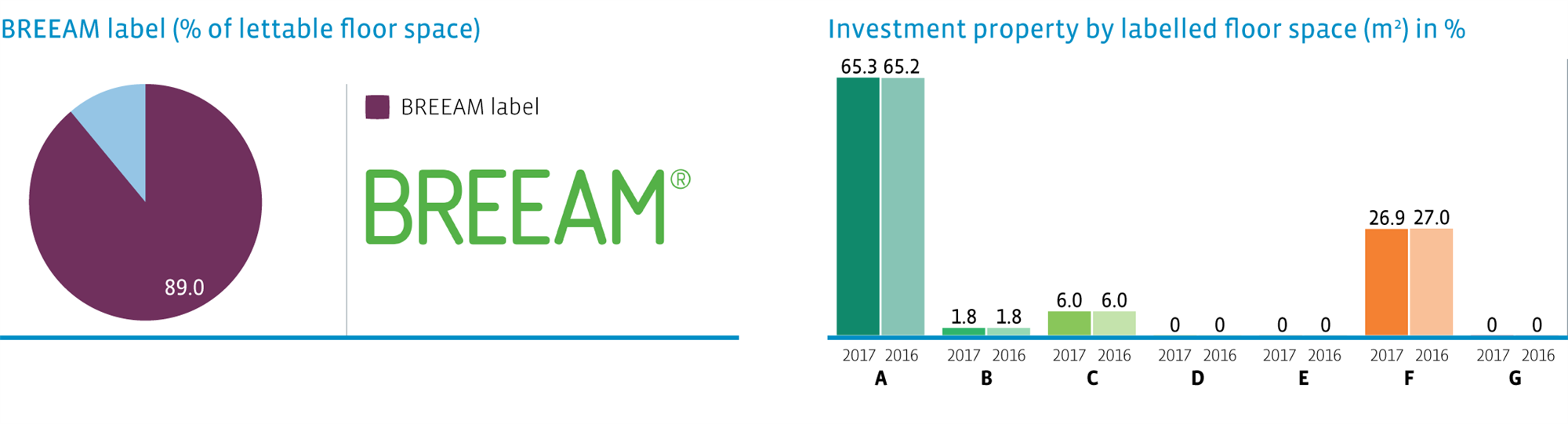

The Fund uses BREEAM to measure and assess the overall sustainability of its buildings. The BREEAM methodology covers a wide range of subjects; from energy to transport, from vegetation and materials to indoor climate quality. This makes it a very useful tool to implement sustainability at different levels within the Fund. The target for 2017 was to achieve a BREEAM ‘Good’ rating for every asset in the portfolio. In 2017, all the Fund’s assets were awarded a BREEAM NL In-Use certificate, except for two small assets in central Amsterdam, following a negative cost-benefit analysis. The figure below shows all the certificates obtained per asset.

BREEAM label per asset

| | ASSET |

Investment property | |

Nieuwe Vaart (#500, Utrecht) | GOOD |

Nieuwe Vaart (#550, Utrecht) | GOOD |

Nieuwe Vaart (#600, Utrecht) | GOOD |

WTC The Hague (Offices) | EXCELLENT |

WTC The Hague (Parking) | n/a |

Centre Court (Offices, The Hague) | VERY GOOD |

Centre Court (Parking, The Hague) | n/a |

Valina (Amsterdam) | VERY GOOD |

Lairessetraat (Amsterdam) | - |

Valeriusplein (Amsterdam) | - |

Olympic Stadion (Offices, Amsterdam) | GOOD |

Olympic Stadium (Parking, Amsterdam) | n/a |

WTC Rotterdam (Offices, high-rise) | GOOD |

WTC Rotterdam (Offices, low-rise) | GOOD |

WTC Rotterdam (Parking P1/ P2) | n/a |

WTC Rotterdam (Parking Leeuwenstraat) | n/a |

Maasparc (Rotterdam) | GOOD |

Investment property under construction* | |

Hourglass (Amsterdam) | EXCELLENT* |

Building 1962 (Amsterdam) | GOOD* |

Building 1931 (Amsterdam) | GOOD* |

| | |

*BREEAM certificate to be received after construction | |

In close collaboration with our property managers, we have developed a BREEAM maintenance contract, which enables us to monitor and implement further sustainability improvements in the maintenance budgets of assets.

Another target related to the sustainability at asset level is to achieve a 100% green portfolio (EPC label A, B or C) in 2020. The distribution of energy labels in the portfolio is shown below. Investment properties under construction, in this case Building 1931 & Building 1962 and Hourglass are excluded from this overview. The Fund expects these to receive an energy label A upon their delivery in 2018 and 2019 respectively. Energy label F relates to WTC Rotterdam. Improving the energy efficiency of this asset is more difficult than for other assets due to the listed status of a part of the building. The Fund is currently drawing up a tailor-made improvement plan for this asset. We expect to obtain energy labels A (high-rise section) and C (listed low-rise section) in 2018, after which we will continue to make additional improvements.

Asset sustainability performance