Sustainability performance at Fund level

Benchmarking based on GRESB enables the Retail Fund to improve sustainability. It provides us with the information we need to report the performance and targets within our assets on a regular basis. We use the GRESB tool to report annually on the Fund’s CSR performance. We can therefore add new objectives or actions after the assessment.

In 2014, the Fund was awarded Green Star status in the annual GRESB assessment. The Fund has retained this status to this day. In 2016, GRESB introduced a new star-rating, which is based on the GRESB score and its quintile position relative to the GRESB universe. The Fund was awarded a four-star status in 2016 (on a scale of 1-5). The target for 2017 was to retain this status, to improve the overall score and outperform the Fund’s peer group. The Fund did outperform its peer group and is currently third of eight in the ranking for Dutch Retail funds. The Fund was again awarded four-star status; the overall score remained the same at 74 (GRESB average 63).

Sustainability performance at asset level

The Fund uses BREEAM to measure and assess the overall sustainability of its buildings. The BREAAM methodology covers a wide range of subjects; from energy to transport, from vegetation and materials to indoor quality. This makes it a very useful tool for the implementation of sustainability measures at various levels within the Fund.

The Fund received a BREEAM award for its efforts in responsible and sustainable investing in real estate at the 2017 BREEAM Awards in London. The award is part of a new category that resulted from cooperation between BREEAM and GRESB and constitutes international recognition for real estate investors that have played a leading role in implementing sustainability accreditation across their portfolio assets. In addition, the award also takes into account the level of effort made to implement sustainability measures throughout the portfolio and the corporate commitment to achieving higher goals.

The 2017 target for sustainability measures was to achieve a BREEAM ‘Good’ rating for new developments, acquisitions and major renovations in the portfolio and to make progress with BREEAM labelling to ensure 100% BREEAM labelling of all shopping centres by the end of 2018. In 2017, six assets received a BREEAM-NL In-Use or New Construction and Renovation certificate. In addition, six assets completed the self-assessment scan, which is a first step towards applying for certification. The Fund has devised an asset sustainability plan for each asset aimed at improving sustainability performance. As planned, the other assets will be labelled in 2018.

The figure below shows all certificates obtained per asset.

BREEAM label per asset

Asset | BREEAM-label | Type |

Westerhaven, GRONINGEN | Pass | In-Use |

Makado, PURMEREND | Pass | In-Use |

Goverwelle, GOUDA | Good | In-Use |

De Promesse, LELYSTAD | Good | In-Use |

Damrak, AMSTERDAM | Very Good | Ontwerp |

Nieuwendijk 196, AMSTERDAM | Very Good | Ontwerp |

Spui/Grote Marktstraat, THE HAGUE | Good* | In-Use |

De Munt, WEERT | Good* | In-Use |

Heyhoef, TILBURG | Pass* | In-Use |

Molenhoekpassage, ROSMALEN | Good* | In-Use |

Maasplaza, DORDRECHT | Very Good* | In-Use |

Boterhoek, BEST | Pass* | In-Use |

* Self-assessment ready

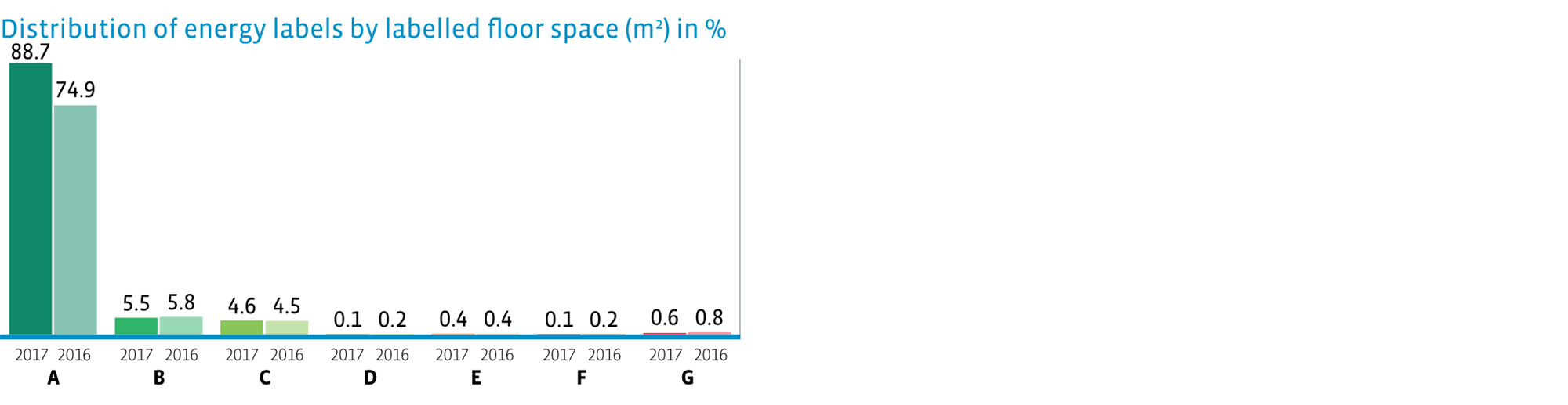

Another target related to the sustainability at asset level was to achieve a 100% green (energy label A, B, C) portfolio at year-end 2018. In 2017, the fund also carried out measures to increase the sustainability of its assets. The sustainable redevelopment of Molenhoek shopping centre in Rosmalen, which included adding insulation to the outer facade of concrete plates and renewing the roof area, improved the centre's energy label to A from G. In addition, the new shopping centres Stadionplein and Mosveld in Amsterdam also obtained an A label. This led to a sharp increase in the total assets with a green label to 98.8% (2016: 85.2%), indicating a good overall level of energy efficiency for the portfolio.

Distribution of energy labels in the portfolio