Portfolios

Bouwinvest has a family of funds structure with three international mandates and five Dutch funds.

Family of Funds

Name | Size 2017 | Secured pipeline 2017 | Target size 2020 | Return 2017 | Relative performance 2012-2016 |

Europe Mandate | € 1.0 billion | € 175 million | € 1.5 billion | 10.9% | 1.1% |

North America Mandate | € 1.0 billion | € 183 million | € 1.5 billion | 6.2% | 1.5% |

Asia Pacific Mandate | € 0.6 billion | € 135 million | € 1.3 billion | 16.2% | (2.9)% |

Residential Fund The Netherlands | € 4.8 billion | € 689 million | € 6.0 billion | 15.6% | 2.1% |

Retail Fund The Netherlands | € 0.9 billion | € 8 million | € 1.1 billion | 7.8% | 3.1% |

Office Fund The Netherlands | € 0.6 billion | € 113 million | € 0.9 billion | 13.1% | 0.3% |

Hotel Fund The Netherlands | € 0.2 billion | € 40 million | € 0.6 billion | 13.4% | - |

Healthcare Fund The Netherlands | € 0.1 billion | € 71 million | € 0.5 billion | 8.0% | - |

Europe mandate

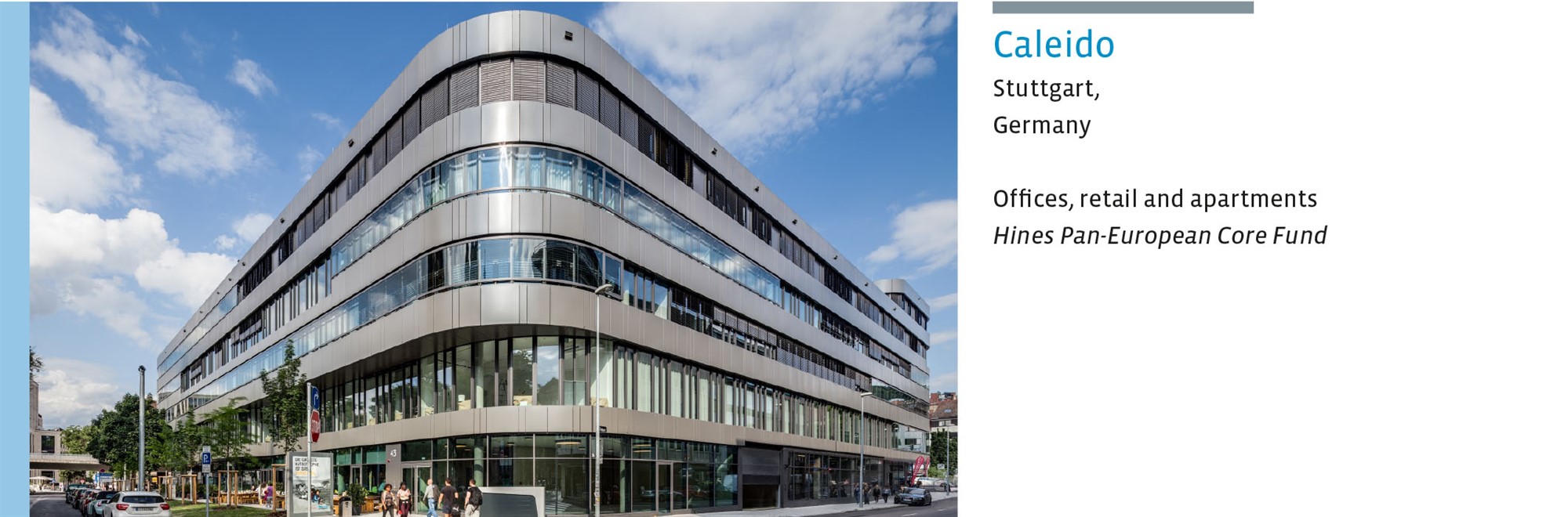

Bouwinvest’s European portfolio recorded a return of 10.9% in 2017 (2016: 2.7%). At year-end 2017, the portfolio had a value of € 1,009 million. In 2017, we invested a total of € 141 million in residential, office, retail and logistics real estate. Last year, 35.5% of the investments in the European portfolio had GRESB 4 or 5-star labels.

Looking forward, Bouwinvest sees excellent opportunities for investments in residential and student accommodation in France, Germany, the United Kingdom and Ireland.

North America mandate

Bouwinvest’s North American portfolio recorded a return of 6.2% in 2017 (2016: 8.8%). At year-end 2017, the portfolio was valued at a total of € 1,024 million. Over the past year, we invested € 188 million in residential real estate, high street retail properties and grocery stores and logistics centres. At this point in time, 32.4% of our investments in the North American portfolio have a GRESB 4 or 5-star label.

Bouwinvest’s plans for the future of the North American portfolio include investments in rental residential properties, healthcare-related real estate, offices and logistics centres. The top 10 more secondary urban areas in North America with stable populations and growing employment offer some interesting investment opportunities.

Asia-Pacific mandate

Bouwinvest’s Asia-Pacific portfolio recorded a return of 16.2% in 2017 (2016: 2.7%). At year-end 2017, the Asia-Pacific portfolio was valued at € 629 million. In 2017, Bouwinvest invested € 130 million in offices, retail real estate and student accommodation. At year-end 2017, 35.6% of Bouwinvest’s investments in its Asia-Pacific portfolio had been awarded GRESB 4 or 5-star labels.

For the period ahead, Bouwinvest sees some excellent opportunities for investments in family homes (Japan, Australia and China) and student accommodation in Australia. We have also set our sights on both unlisted and listed prime logistics real estate in certain emerging markets.

Residential Fund

In 2017, the Residential Fund recorded a total return of 15.6% (2016: 20.5%), with a direct return of 2.8% (2016: 3.4%). The direct return percentage was lower than last year due to the fact that the fund currently has a substantial pipeline that is not yet generating any rental income. The direct return was also lower because rental increases failed to keep up with house price rises. The Residential Fund booked an indirect return of 12.8% in 2017 (2016: 17.1%). The Fund maintained its stable occupancy rate, which came in at around 98% last year. The average rental price increase was 2.9% in 2017 (2016: 3.2%).

At year-end 2017, the Fund’s portfolio included 240 assets with a value of € 4.1 billion. The Fund added a total of 1,017 apartments and 131 family homes to the portfolio in 2017. Additionally, the Fund divested portfolio properties with a book value of € 52 million, as these properties no longer met the Fund’s strategic criteria.

In 2017, we once again exceeded our acquisition target for this fund. We invested a total of € 300 million in 773 apartments and 383 family homes. Due to the relatively limited supply and major demand from investors, the Residential Fund has broadened its focus slightly to include suburban areas and medium-sized cities with a strong growth outlook. Last year, the Residential Fund made 18 acquisitions in various locations in Amsterdam and Rotterdam, as well as cities such as Hoofddorp, Purmerend and Zwolle.

In 2017, existing clients added € 215 million to their investments in the Residential Fund. At 1 January 2018, the Fund also succeeded in adding a new client, which invested a total of € 300 million. The Residential Fund currently has a total of 17 investors.

For the fourth year in a row, the Residential Fund was awarded a GRESB four-star rating. The Fund’s return was also above the average recorded in the IPD Property Index.

Retail Fund

Bouwinvest’s Retail Fund recorded a total return of 7.8% in 2017 (2016: 8.5%). This was the result of a direct return of 4.5% (2016: 4.6%) and an indirect return of 3.3% (2016: 3.9%). The average rate came in at 95.6% in 2017 (2016: 94.2%).

At year-end 2017, the Retail Fund’s portfolio included 49 assets with a value of € 0.9 billion. In line with the Fund’s strategy, it also invested more in (supermarket-anchored) shopping centres for daily necessities (convenience). But the fund also invested in a number of stand-alone shops in city centre high streets. Last year, the Fund also completed the renovation of Molenhoek shopping centre in Rosmalen, including an upgrade of the centre’s sustainability rating (now A-label rated).

The Fund added one new client in 2017 and now has a total of five clients. Two investors added a total of € 55 million to their investments in the Retail Fund last year.

The Retail Fund was awarded a GRESB four-star rating for the fourth year in a row in 2017. The Retail Fund also outperformed the IPD Property Index.

Last year’s most significant transactions included the acquisition of the Slangenbeek shopping centre in Hengelo (11 retail units, including two supermarkets) and the Oosterheem neighbourhood shopping centre in Zoetermeer (38 retail units, including three supermarkets). The Fund also acquired two high street shops in Nijmegen.

Office Fund

Bouwinvest’s Office Fund recorded a total return of 13.1% in 2017 (2016: 5.5%). The direct return came in at 2.9% (2016: 3.6%) and the indirect return at 10.2% (2016: 1.9%). The positive movement of the indirect return was a result of the positive revaluation, which was particularly marked in the Amsterdam market.

At year-end 2017, the Office Fund portfolio included 14 assets with a value of € 0.5 billion. The Fund did not make any new acquisitions in 2017. Nor did it dispose of any office assets. The Fund did invest some € 47 million in the optimisation of the portfolio.

In 2017, the Fund saw its average occupancy increase to 86% (2016: 81%). The new lease transactions related to Nieuwe Vaart in Utrecht – an office complex for companies with a clear corporate social responsibility profile – were the main driver of the higher occupancy rate. Plus the upgrades at the WTC The Hague and the renovation of the WTC Rotterdam also paid off in terms of higher occupancy rates. The Fund is looking to the future with confidence, thanks to a number of positive developments, including a multi-year lease for the Centre Court office building in The Hague.

The Fund welcomed one new investor in 2017 and now has a total of three clients. These clients committed to investments of € 145 million in the Office Fund in 2017.

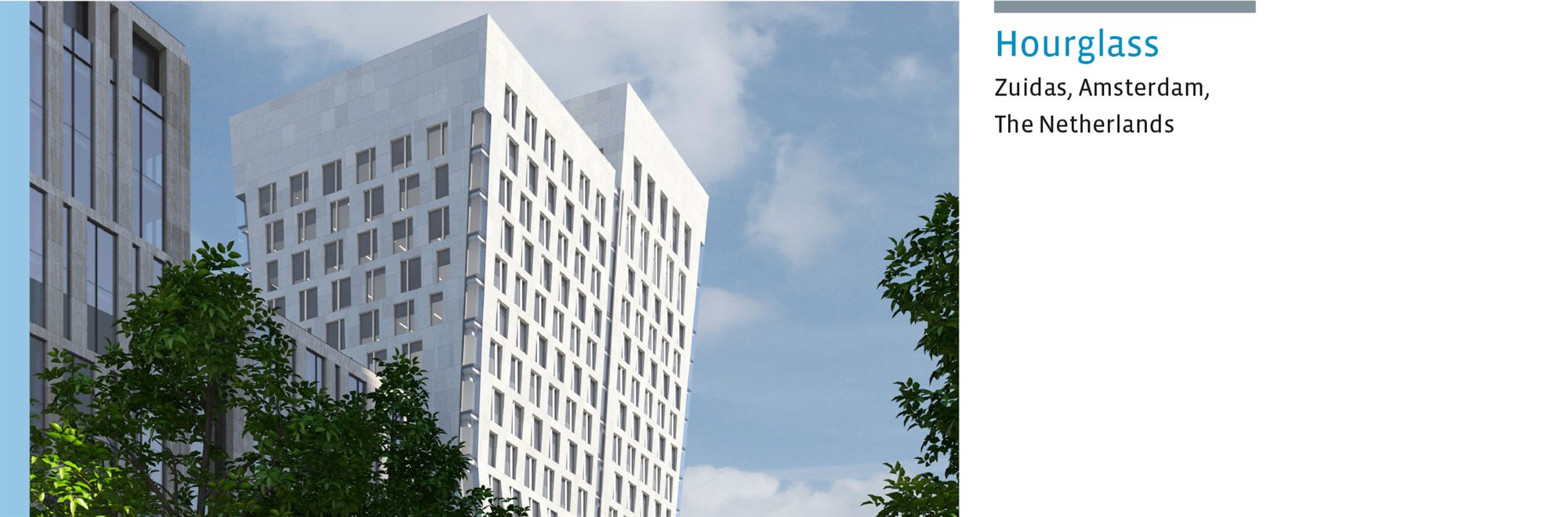

Last year saw the start of construction on the Hourglass building in Amsterdam’s Zuidas business district, as well as continued progress on the redevelopment of Building 1931 and Building 1962 (former Citroën buildings), also in Amsterdam. Thanks to these investments, we believe the Fund will once again outperform the IPD property index in the future, as it did in the years 2012 and 2013.

The Office Fund improved its GRESB benchmark score in 2017 and was once again awarded a five-star rating, the highest score in the GRESB universe.

Hotel Fund

The Hotel Fund recorded a total return 13.4% in 2017 (2016: 14.2%), with a direct return of 5.4% (2016: 6.1%) and an indirect return of 8.0% (2016: 8.1%).

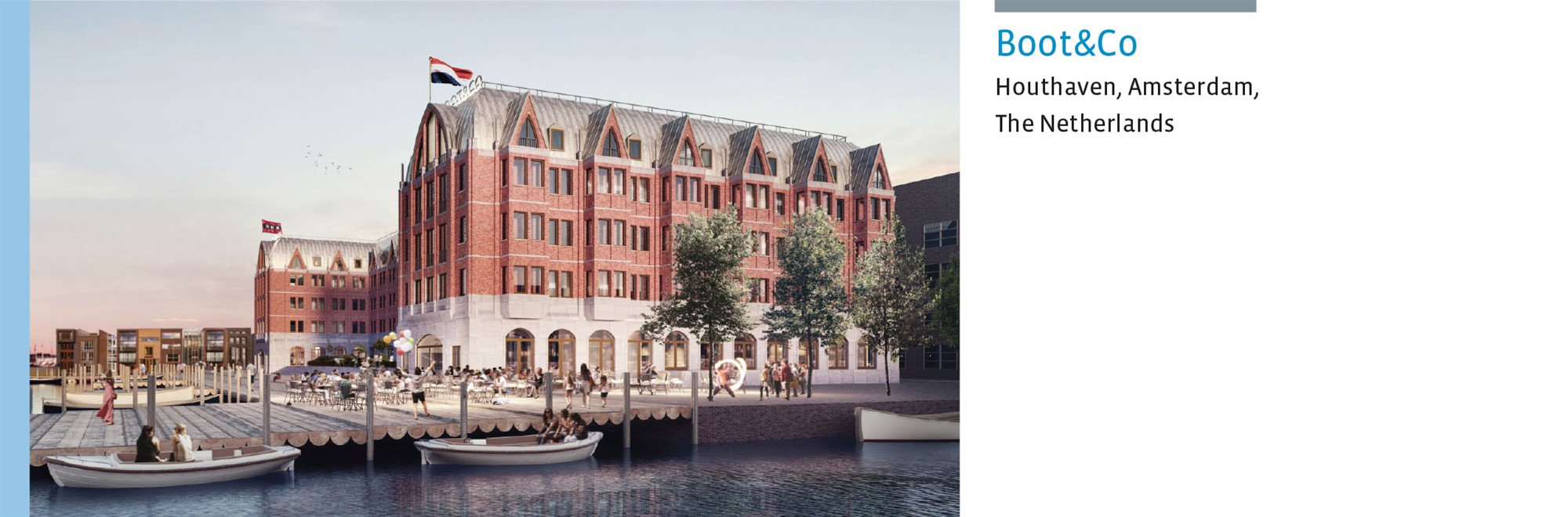

At year-end 2017, the Hotel Fund had a portfolio of four assets with a value of € 0.2 billion. The Fund portfolio comprises four hotels in The Hague and Amsterdam, with a total of 1,120 rooms. The Fund’s pipeline includes three projects in Amsterdam (Hourglass, Boot&Co and AmstelTower), with a total of 383 rooms. The Fund has signed lease agreements for the new hotels with terms of between 20 and 25 years.

The Hotel Fund improved its GRESB score considerably last year and was awarded a two-star label. All of the Fund’s hotels have green energy labels.

Healthcare Fund

Bouwinvest’s Healthcare Fund recorded a total return of 8.0% in 2017 (2016: 4.9%), with a direct return of 3.0% (2016: 3.7%) and an indirect return of 5.0% (2016: 1.2%).

At year-end 2017, the Healthcare Fund’s portfolio comprised seven assets with a total value of € 58 million. The Fund stepped up its investments considerably last year, signing transactions with a value of € 73 million related to independent assisted care apartments and intramural care properties in Apeldoorn, Leidschendam, Almere, Heiloo, Amsterdam and Groningen. The Fund did not dispose of any healthcare properties in 2017. The Healthcare Fund was awarded a GRESB one-star label in 2017.

Last year’s largest investment was the acquisition of a healthcare centre with group residences for patients suffering from dementia, 48 individual assisted care apartments and related facilities in the Life complex in Amsterdam’s Houthavens district. Healthcare organisation Zorgmensen/Siza will lease a healthcare complex with 105 units for both nursing care and care for people suffering from dementia on the site of the former Juliana Hospital in Apeldoorn. Healthcare provider Florence is set to lease 74 studios for people suffering from dementia in a complex located at Nieuwe Mariënpark 74 in Leidschendam.